CoreLogic’s national median rent value has reached a series high of $601 per week, equivalent to an annual median rent of $31,252 and a big jump from $437 per week in August 2020.

The CoreLogic median rent is derived from a current estimate of rental income, describing the amount the median dwelling in Australia would command if listed on the market at any given time.

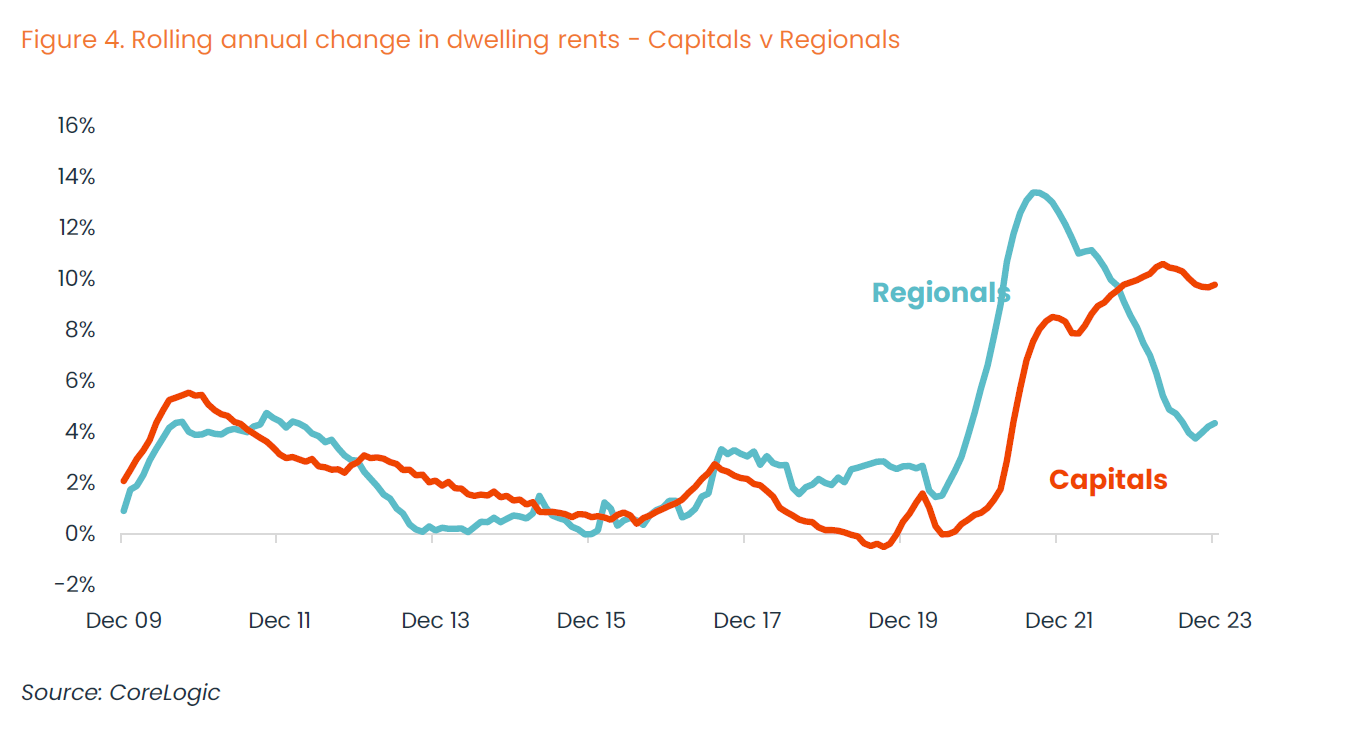

Recent rent growth has averaged 9.1% annually for the past three years, in stark contrast to the 2% average annual growth in the 2010s.

Eliza Owen (pictured above), head of research Australia at CoreLogic, said contributing factors to the substantial increases included a decline in average household size, a surge in the Australian population post-2022, and a temporary shock to investment housing activity between May 2022 and February 2023.

Longer-term trends, such as a reduction in social housing supply and a decline in homeownership, have also heightened demand for rentals, putting pressure on the private rental market.

Also adding to the increased demand, Owen said, was the gradual decline in average household size over decades, influenced by economic and demographic factors such as an increase in people living alone, has necessitated more dwellings to accommodate the growing population.

But with rent value increases consistently outpacing both wage and income rises at the national level, it has led to a deterioration in rental affordability.

The portion of gross median household income required to service median rent rose from 26.7% in March 2020 to 31.0% in September last year.

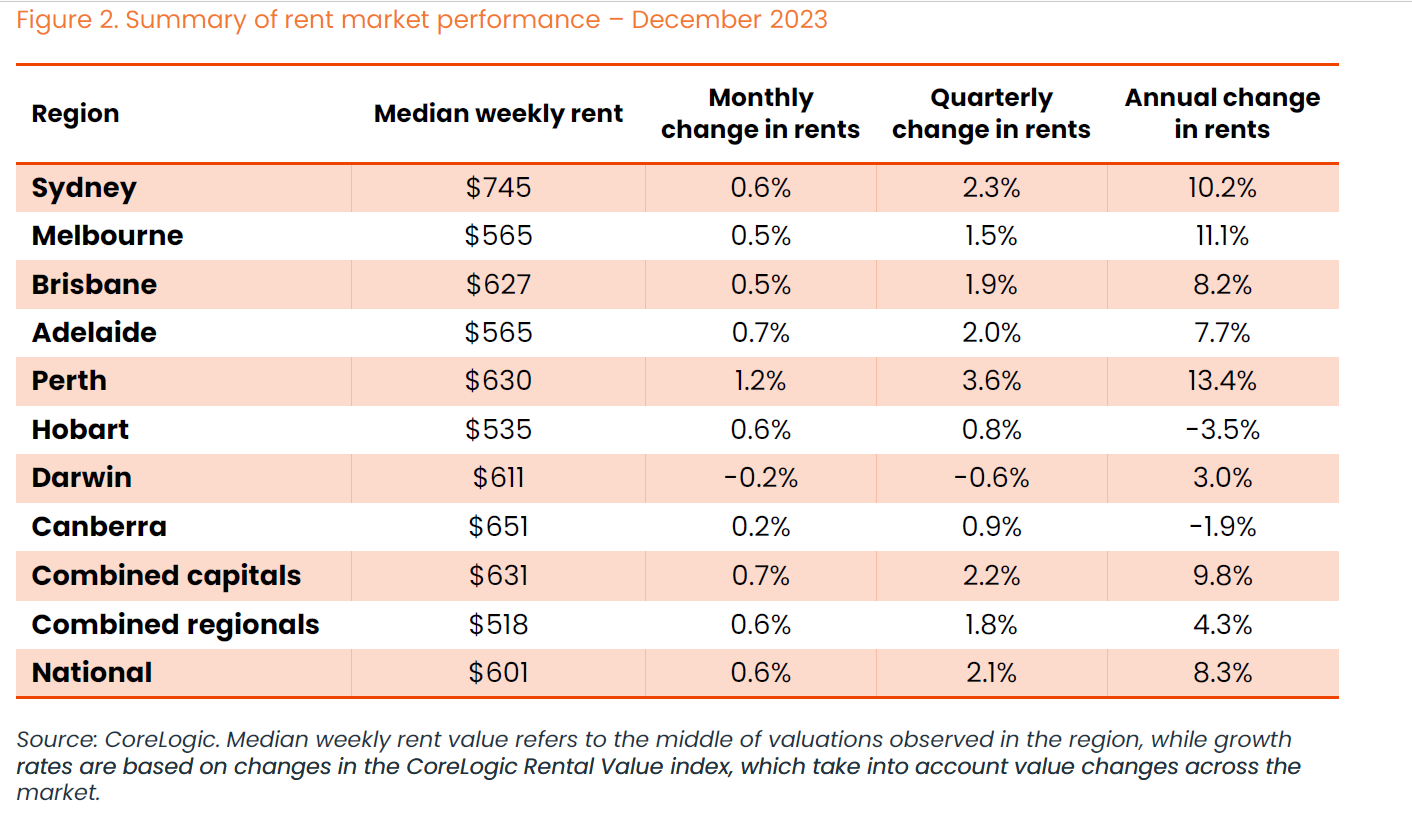

Median rents across capital city markets varied, ranging from $745 per week in Sydney to $535 per week in Hobart. Canberra and Hobart witnessed a decline in rent values in 2023, at -1.9% and -3.5%, respectively.

While annual rent growth remained higher than historic averages, it has broadly slowed. In 2023, rent values rose 8.3%, down from a peak of 9.6% in the year to September 2022. The slowdown is more evident in regional Australia, with rents rising 4.3% last year.

“The slowdown in rent growth may be attributed to affordability constraints driving renters back to share housing, or to cheaper markets,” Owen said. “Additionally, the recent resurgence in investor activity through 2023 may be gradually helping to ease supply-side constraints.”

CoreLogic has also noted a slight pick-up in rent growth in the final quarter of 2023, with this re-acceleration in rents most consistent across the capital city house markets but was also evident in regional rent markets.

“Part of the explanation for an uptick in house rent growth may be in part due to households re-grouping into share houses,” Owen said.

“Additionally, the premium of house rents over units has narrowed in the past two years, from $63 per week at the median level to $38. This ‘catch up’ in unit rents could be making them less appealing, diverting tenants back to houses.

“Part of the explanation could also be compositional: more affordable rental markets, such as regional or outer-suburban markets, are typically higher in detached houses.”

Despite this, rent growth is expected to slow in the coming year, influenced by increased investment lending, net overseas migration normalisation, and potential cash rate reductions.

“However, in the short term, the burden largely remains on tenants to secure cheaper housing, whether that be by re-forming share house arrangements, or once again looking to regional or outer suburban markets for rental accommodation,” Owen said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.