Data recently made available from the Australian Bureau of Statistics (ABS) revealed that the total number and value of refinanced home loans peaked in May 2020, with refinancing activity posting its largest month-on-month increase in nearly 20 years and rocketing more than 90% year on year.

The total value of refinanced home loans exceeded $15.1bn in May, up 26% from the previous high of $12bn in April.

Notably, the month saw record highs for both external refinance loans – those involving people switching lenders – as well as internal refinance loans, when customers opted to secure a better rate from their current lender.

Over the month of May, external loans reached 21,473 and internal loans sat at 12,239.

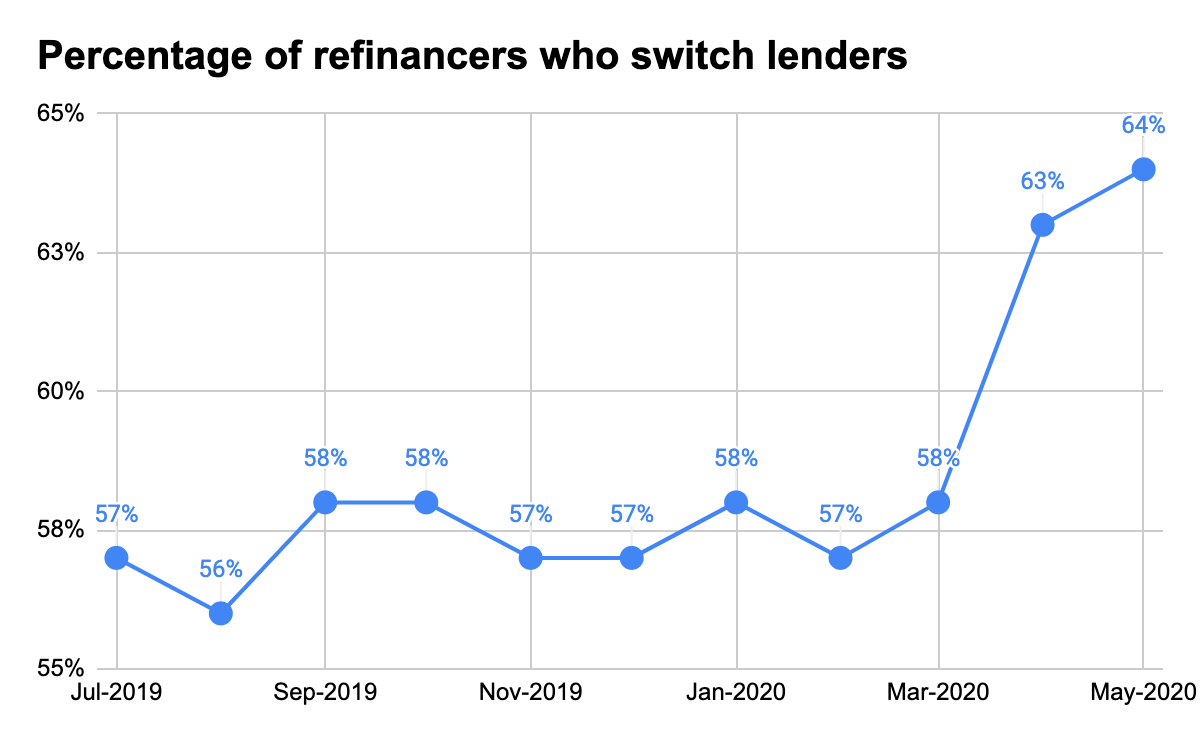

Of all refinanced loans, 64% involved Australians switching lenders – “the largest disparity ever”, according to Graham Cooke, insights manager at comparison site Finder.

“As budgets are stretched, a record number of people are deciding to get a better deal on their largest investment,” he said.

“Historically low interest rates and a lack of investor spending are a double whammy to banks, but a boon for mortgage holders.

“With the cash rate at 0.25%, the best home loan rates now start with a two. If yours does not, it might be time to go home loan shopping.”

According to Finder analysis, the average standard variable rate from the big four banks for an average loan of $494,462 is 4.04%. If that rate were to drop 50 basis points to 3.54%, more than $35,000 could be saved over the life of the loan.

“Now is a good time to ask for your bank to go the extra mile,” said Cooke.

“Several lenders are offering to waive fees for new borrowers, and some are even offering extras like offset accounts at no additional cost.

“While the value of houses may well drop in the next year, the mortgages on them will not.”