Australians with mortgages are making significant sacrifices to keep up with their home loan repayments, according to new research from comparison site Finder.

A survey conducted by Finder of 1,062 participants – including 346 mortgage holders – uncovered that one in four (25%) mortgage holders have had to skip paying for other essential expenses to prioritise their home loan.

This translates to an estimated 825,000 Australians struggling with cash flow each month as they strive to keep a roof over their heads.

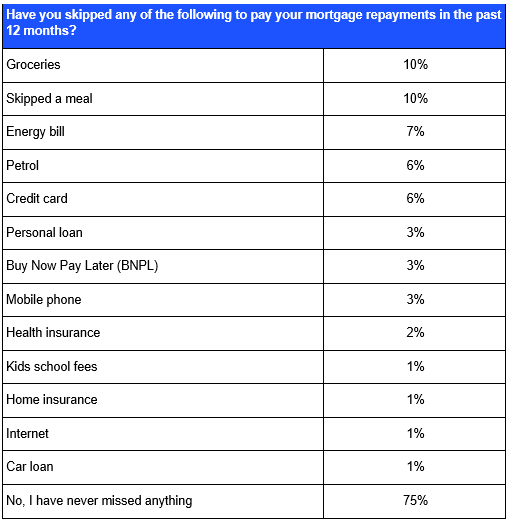

The Finder research showed that one in 10 borrowers have skipped buying groceries, with another 10% going so far as to skip meals to cover their increasing mortgage repayments.

Other bills such as energy (7%), petrol (6%), and credit card payments (6%) were also neglected in order to prioritise their mortgages.

Finder’s home loans expert, Richard Whitten (pictured above), highlighted the increasing financial stress faced by Australians.

“Aussies are increasingly running out of money each month and have to choose which bills to pay and which to delay,” Whitten said. “A roof over your head comes first, even if it means skipping other important expenses.”

Over the last decade, home loan sizes have increased significantly, leaving many households stretched financially.

Whitten noted that missed and late payments on bills and utilities could damage credit scores.

“If you are worried you won’t be able to afford a bill, contact your provider to discuss payment plans or hardship options,” he said. “Shopping around for a better interest rate or switching to interest-only mortgage payments could also help in the short term.”

The survey also revealed that some borrowers had missed payments on personal loans (3%), buy now pay later (BNPL) services (3%), and mobile phone bills (3%). Others had skipped paying for health insurance (2%), school fees (1%), home insurance (1%), and internet bills (1%) to manage mortgage obligations.

As of July, the average Australian home loan stood at $641,143 – a 1.1% increase from the previous month and an 8.0% rise compared to the same time last year, Finder survey found.

Whitten warned that “mortgage debts are sky-high, and the hard truth is that people’s expenses exceed their incomes, leaving households vulnerable.”

Australians are being urged to explore financial support options and plan for the future as the economic squeeze continues.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter