Australian home loan sizes hit a record average of $640,998 in July, a 0.7% increase from the previous month, with Mozo’s Rachel Wastell (pictured above) highlighting the growing financial strain on borrowers as property prices rise.

Home buyers are now paying $2,101 more per month compared to five years ago due to rising interest rates and loan amounts.

See LinkedIn post here.

The hidden cost of Aussie dream homes

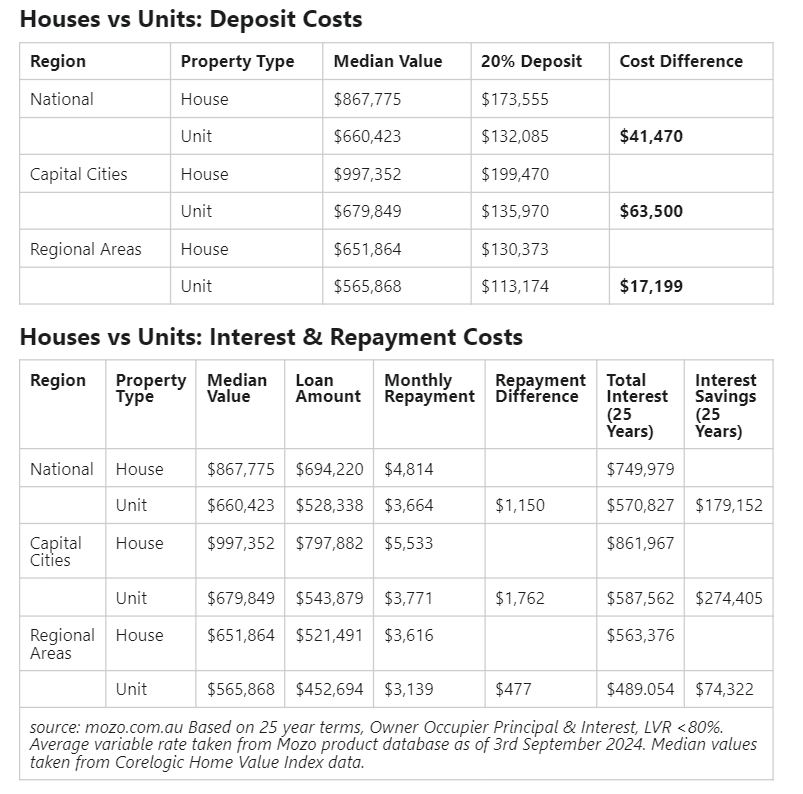

Despite units being up to 32% cheaper than houses, many Australians still prefer houses, leading to significant extra costs.

Mozo’s research showed that choosing a house over a unit in capital cities could mean paying $1,762 more in monthly mortgage repayments and up to $274,405 more in interest over 25 years.

“The great Australian dream of owning a house may need to shift to owning a unit if buyers want to borrow less and save more,” Wastell said.

The broader economic slowdown is reflected in the national income account figures, which showed that GDP per capita has fallen for the sixth consecutive quarter, dropping 0.4%.

Wastell highlighted the impact of rising housing costs on the economy, stating that higher property prices are “having pressure on household budgets, consumer spending, and as a result, economic growth.”

As the property market continues to evolve, Mozo provided key insights for prospective home buyers.

“Prospective buyers should be considering whether paying the additional cost that comes with a house is justified,” Wastell said, urging Australians to reassess the financial trade-offs between houses and units.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.