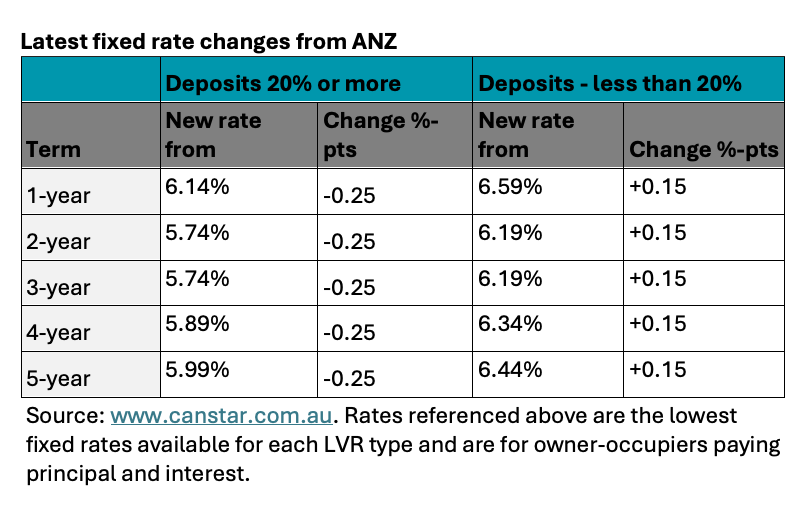

ANZ has announced a 0.25 percentage point reduction in fixed rates for both owner-occupiers and investors with deposits of 20% or more, Canstar reported.

This marks the second time in less than three weeks that the bank has lowered its fixed home loan rates, following a significant cut of up to 0.7 percentage points on Oct. 11.

Despite the reductions for customers with larger deposits, ANZ has increased fixed rates by 0.15 percentage points for those with deposits of less than 20%.

This mixed approach highlights the bank’s strategy to balance risk while remaining competitive in the market.

ANZ’s recent cuts align with a broader trend among major banks to reduce fixed rates. Notable reductions from other banks include:

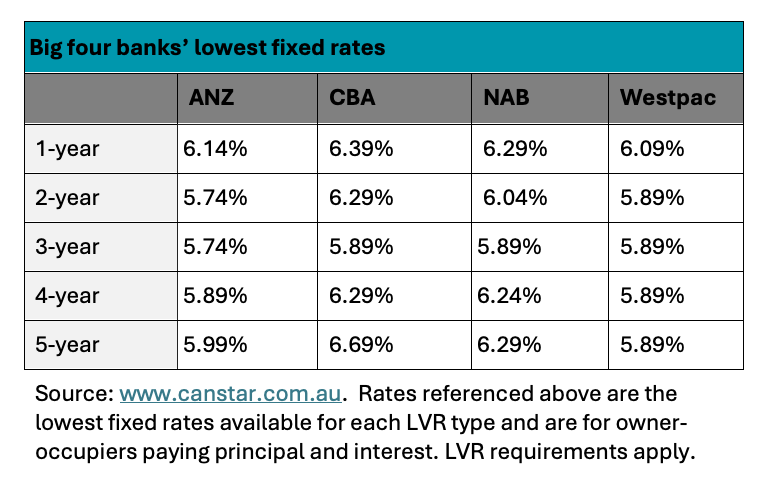

With this latest round of cuts, ANZ now offers the lowest fixed rate among the big four banks.

“This strategic play from ANZ means the bank now offers the lowest fixed rate out of the majors as competition in this space continues to push rates south,” said Sally Tindall (pictured above), research director at Canstar.

Tindall noted that while ANZ’s new lowest rate of 5.74% may not prompt a rush to fixed rates, it could encourage borrowers to reassess their mortgage options.

“It could still be enough to encourage some borrowers to stop and do a health check on their mortgage,” she said.

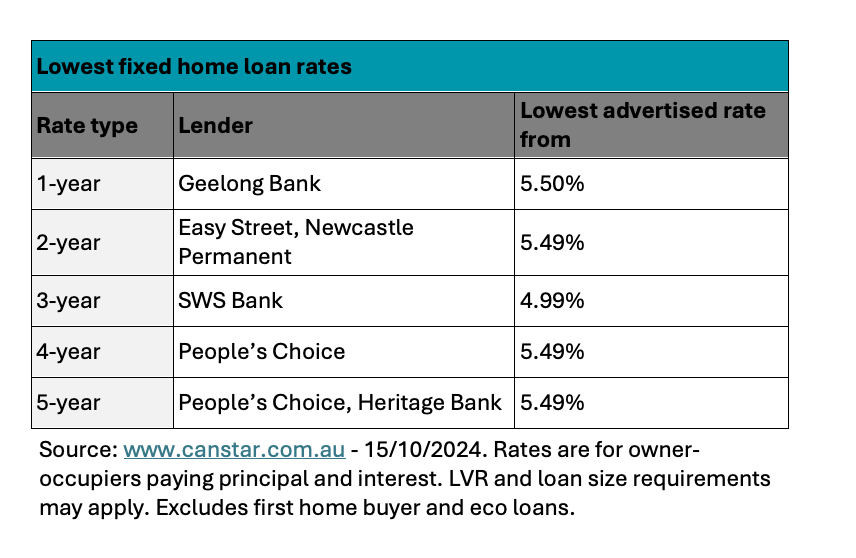

“This new rate from ANZ might be the lowest out of the big banks, but it's still a world away from the lowest rate in the market at 4.99% for a 3-year term. That’s really the head-turner in the fixed rate space.”

Despite its competitive positioning, ANZ’s strategy includes a 0.45 percentage point premium for borrowers with lower deposits.

“Risk-based pricing is nothing new, but it's interesting to see the bank lean into this strategy in a bid to attract safer borrowers onto its books at a time when property prices appear to be cooling,” Tindall said.

According to Canstar, almost 30 lenders have cut at least one fixed rate in October, while only five have increased their rates, illustrating a continuing trend of falling fixed rates across the market.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.