By

The lending industry is full of different kinds of operators with varying levels of skill and knowledge, and many of them have come from other professions.

This was brought home to me during one loan deal when an assessor, with significant experience in mortgage credit and accounting, picked up my application.

If you score someone like this with your next deal, you may need to prepare for things to get nitpicky and technical for your self-employed client.

The scenario

Two successful tradies, cousins Chris and Paul, had grown up having annual holidays with family in a house on NSW’s Central Coast. It was a home that held many childhood memories for them.

The property was put up for sale mid last year. Both cousins now have young families of their own, so the prospect of buying the house was an opportunity they simply could not pass up. They were very excited to carry on the family tradition of making memories in this special holiday home.

Without delay, they conditionally signed and exchanged contracts to purchase the property together. It was only afterwards that Chris came to me to discuss financing the purchase.

Chris and Paul did not want a debt on their proposed purchase, preferring to keep it mortgage-free. The plan was for the home to be enjoyed by their family members and also be listed on Airbnb for the occasional booking.

To support this objective, Paul would use cash to pay for his portion of the property, while Chris would use equity from an existing investment property.

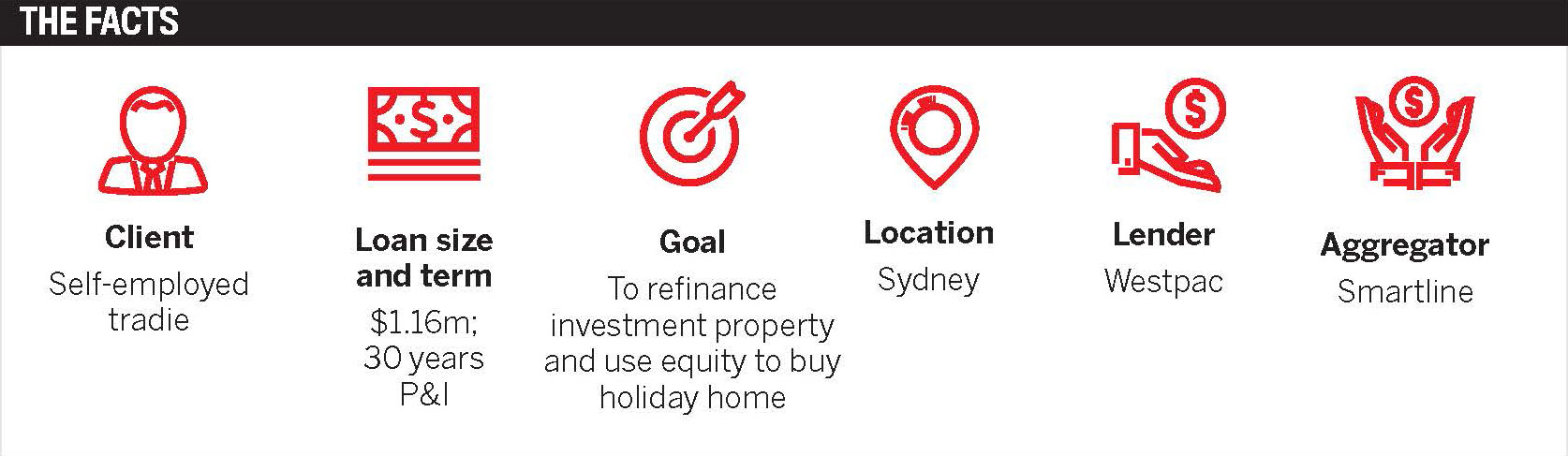

We decided that Chris would refi nance one of his existing investment properties (valued at around $1.5m) to achieve an equity release of $596,000 so that he and his cousin could purchase the holiday home outright. The total LVR for the new loan was only 70%.

The investment property off ered by the client had enough equity, but as with most things in lending, nothing is ever easy, is it?

The property, a duplex, had been newly constructed and was awaiting the occupancy certificate and completion of the land title subdivision process.

With every deal, we must prepare for ahigh level of scrutiny. That is our currentcredit environment, and it is here to stay

In addition, upon reviewing the last two years’ tax returns, a peculiar item was picked up in the ‘loans to related parties’ column, with a significant amount of money attached to it. When I enquired about it, Chris assured me that the ‘related party’ was himself.

Aside from these anomalies, the taxable incomes of the individual and company were more than enough to service the new loan.

Having access to the proposed banks’ credit assessors, and with customer experience in mind, I called them to discuss the two potential hurdles, and they were more than happy to consider these two issues, having been given the heads-up.

However, the credit assessor assigned to my clients’ application had a bit of a field day. Stating that his prior experience was as an accountant, he said he was convinced that the ‘related party’ referred to must be a third party, thus profits were not being retained within the business.

With that decision made, the loan was declined.

The solution

While business development managers are not typically involved in customer communications, they are certainly critical to the customer experience. In this case, it was thanks to the assistance of my BDM that we were able to overturn this decline.

Armed with a full history of business and personal statements, and having the client’s accountants at hand as well as the support of my BDM, after several days of patience we went in to battle for the client.

In the end, we were able to provide enough comfort to the lender’s credit team that profi ts were retained within the business and by the sole business owner, my client Chris.

The takeaway

Utilising your BDM and credit scenarios team (if available) is key to minimising credit surprises.

With every deal, we must prepare for a high level of scrutiny. Nothing flies through to unconditional approval with a ‘no worries’ or ‘she’ll be right’ sticker. That is our current credit environment, and it is here to stay. But we can take our knowledge of the environment and use it to improve the customer experience.

Setting the right expectations for our clients and reminding them about the current credit climate serves us and our clients better.

Sometimes decisions take longer than expected and/or more information is requested, but pre-empting this wherever possible can facilitate delivery of the desired outcome.

Meanwhile, Chris and Paul have enjoyed the past summer holidaying with their families at the house, reliving those childhood memories.

Tony Caab

Adviser, Smartline