The scenario

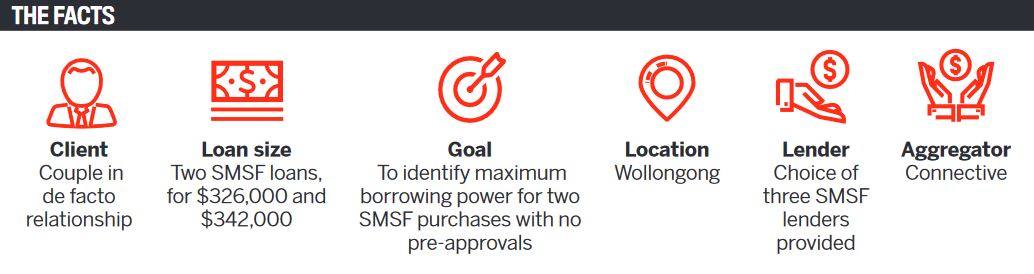

This couple came to Atelier Wealth last year as brand-new clients. We had recently opened our second office in Thirroul, NSW, and they had seen our ‘Welcome to the Community’ post on Facebook.

In January 2018, the pair had approached a bank’s financial planner to buy two properties through their SMSF. This planner advised that “pre-approval isn’t required” and advised the clients that “it should be OK to pay 10% now as a deposit and in two years pay the rest”.

By the end of the month, two SMSF loans had been set up for the couple. In February 2018, the bank planner advised them to put their super fund name (not the ‘bare trust’ name) on the contract of sale. The clients then purchased two off-the-plan properties due for completion in November 2020.

In November 2019 when they came to us, I had an initial meeting with the clients to determine their borrowing power and the funds required for their SMSF property purchases. It became clear that they had neither the cash available in their SMSF to complete these purchases nor the borrowing power to support them.

I completed full servicing calculators and outlined that the maximum SMSF loans available to them would be $320,000 and $308,000 respectively. This meant they would need an additional $140,000 and $115,000 to settle on their SMSF purchases – on top of their existing SMSF cash balance, and on top of their 10% deposit and stamp duty costs.

The clients were astounded.

I suggested they needed to work with a trusted and experienced financial planner to get them the best possible outcome. I made an introduction to one of our trusted fInancial planners, outlining the situation and a couple of generic suggestions for what he could explore with them, including the clients making additional non-concessional superannuation contributions; looking at purchasing the properties in a 13.22 trust structure; and approaching the bank for compensation on both properties before completing on the purchases.

A formal complaint to the bank was lodged. The following day, on Christmas Eve, a call came from the bank’s CEO and an offer of compensation was made

After reviewing the situation, the financial planner was able to outline these fundamental issues in terms of the advice the clients had been given by the bank:

Due to the negligent advice given by the bank’s financial planner associate, a decision was made to lodge a formal complaint to the bank and a request for compensation.

On 23 December 2019, a formal complaint to the bank was lodged. The following day, on Christmas Eve, a call came from the bank’s CEO and an offer of compensation was made. Our clients were offered compensation of $420,000 in total:

With settlement approaching in November 2020, we have identified three SMSF lenders that will lend to our clients based on their current servicing requirements, liquidity tests, net asset tests and location rules. As the properties are not ready to be valued, valuations still need to be completed and formal approval issued. We will now work with the clients to secure formal approval for their SMSF properties.

The takeaways

The key takeaway from these clients is that if something doesn’t look right it probably isn’t, so continue to ask questions until you identify the real issues.

We’ve created an SMSF qualifying tool to help us identify if an SMSF loan is a deal or no deal. As SMSF lenders have different rules, like net asset tests, liquidity tests, and whether they lend to off-the-plan properties or not, this tool has enabled us to quickly and accurately assess if we can find an SMSF loan solution for our clients.

Also, it’s important to ensure you have a network of trusted experts, including financial planners, accountants and conveyancers/solicitors, who you can trust and lean on for your clients. In this case, being able to access accurate advice resulted in compensation worth almost half a million dollars – and the clients are naturally thrilled at the outcome.

Bernadette Christie-David

Bernadette Christie-David

Director and finance broker,

Atelier Wealth