As we prepare for the possibility that the coronaviruspandemic may continue for longer than first anticipated, it’s become essential for brokers to find flexible ways to support customers’ lending requirements.

With many banks and lenders adjusting their application assessment methods, borrowers may be finding it difficult to source the right finance, even if their circumstances remain unchanged.

As a result, we are seeing an uptick in the number of customers opting for specialist loans for all kinds of purposes.

“Customers are becoming increasingly aware of the benefits of specialist lending, and there is a greater understanding of how a specialist loan can support their varied needs. Those who have been affected [by the pandemic] may be looking for more flexible ways to manage their finances, or for better ways to tackle their existing debt. For brokers, these kinds of scenarios provide a real opportunity to help people in very meaningful ways,” explains John Mohnacheff, Liberty’s group sales manager.

John Mohnacheff, group sales manager, Liberty

John Mohnacheff, group sales manager, Liberty

“With increased uncertainty, it is more important than ever for borrowers to have the guidance and support of a trusted broker. This enables brokers to help customers through challenging times and build strong professional relationships, as many borrowers may now need the help of a specialist solution, which creates opportunities for brokers to support their lending needs.”

As borrowers adapt to what has been described by many as the ‘new normal’, it’s likely that appetite for credit will remain strong. The mortgage market is already demonstrating an increase in applications – a trend that is likely to continue as more of Australia gets back to business.

Daniel Carde, general manager distribution at Resimac, says this increase is just one of several major trends in specialist lending at the moment.

“There has been an uptick in debt consolidation and growth in self-employed applications in certain sectors as borrowers take the opportunity to review their lending requirements in the current environment,” he says.

“With increased uncertainty, it is more important than ever for borrowers to have the guidance and support of a trusted broker” John Mohnacheff, group sales manager, Liberty

“In addition, the majority of borrowers for specialist products are consistently meeting our definition of ‘clear’ credit. Many of these borrowers either have no impairment or have historical impairments that are either quite dated or are for small amounts, which are not relevant to their current circumstances.”

“In addition, the majority of borrowers for specialist products are consistently meeting our definition of ‘clear’ credit. Many of these borrowers either have no impairment or have historical impairments that are either quite dated or are for small amounts, which are not relevant to their current circumstances.”

Carde says Resimac hasn’t changed its pricing or credit policy and hasn’t targeted any specific industries, but the lender has found that not all borrowers in affected industries have been impacted in the same way. Therefore, case-by-case assessments have remained the best approach.

“Many impacted employers have retained employees and redeployed some of their workforce into new roles that have become necessary due to a change in their business model. For example, some retailers have shifted their businesses to an online model and redeployed their shop-floor staff into order fulfilment roles,” he says.

The agility and flexibility that specialist lenders hold in being able to approach each deal on a case-by-case basis is one of their core strengths and has allowed them to offer greater support to borrowers and brokers during the pandemic.

In fact, Cory Bannister, chief lending officer at La Trobe Financial, says the last couple of years have given both specialist lenders and brokers alike the opportunity to introduce consumers to a viable option that doesn’t involve the big banks.

Cory Bannister, chief lending officer, La Trobe Financial

Cory Bannister, chief lending officer, La Trobe Financial

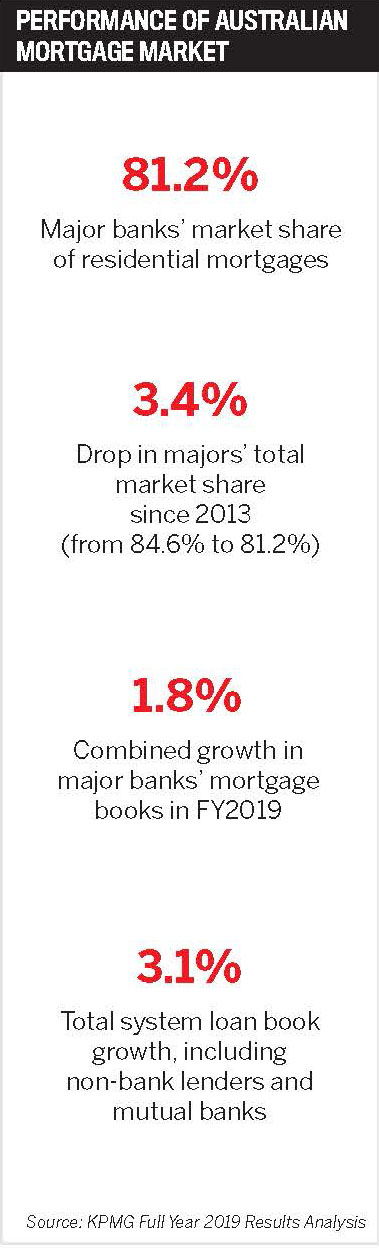

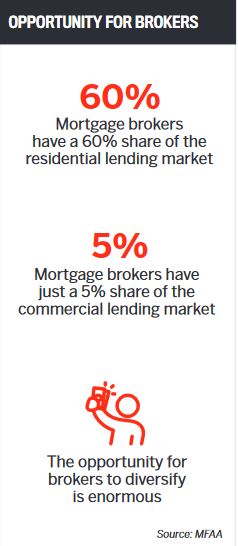

“The biggest single trend in specialist lending, which has been unfolding for two years, has been the persistent tightening of bank acceptance criteria, which has caused much consternation, confusion and uncertainty for many brokers and approval delays for consumers. This in turn is driving more business to brokers and validating the broker to non-bank value proposition,” Bannister says.

“As a result, today’s specialist borrowers were likely to have been the bank prime borrowers of the past decade, a time in which banks moved up the loan risk curve into what had been traditional non-bank or specialist market segments.”

Currently, the major banks appear to have a lower risk appetite and are pursuing a much narrower and borrower-specific segment of the market: the ‘prime vanilla’ home loan – a segment that “can be scaled en masse”, Bannister explains, due largely because highly automated credit processes require very little human intervention or oversight.

“This leaves a large segment of the $360bn annual demand turnover of the residential mortgage market overlooked – and this overlooked sector is a natural market [for specialist lenders]. We’re well positioned and ready to assist this market, as we have for more than seven decades,” Bannister says.

“Today’s specialist borrowers were likely to have been bank prime borrowers of the past decade, a time in which banks moved up the loan risk curve” Cory Bannister, chief lending officer, La Trobe Financial

“The coronavirus has become one of history’s most economically disruptive events, and although governments and regulators across the world have acted quickly, and in force, to minimise its economic effects, the residual impacts on individuals, businesses and economies are still evolving and are highly uncertain. What we do know is that the appropriate provision of credit to the broader economy will be a key and critical lifeblood throughout the rebound and recovery phases. Specialist lenders are best suited to providing credit throughout this period, thanks to the custom nature of our credit assessment methods.”

While the leading attitude at the moment is one of positivity and optimism, and Carde says Resimac is “typically seeing the same type of specialist applications that we saw before the pandemic arrived”, he adds that we haven’t yet seen the full impacts of the pandemic, due to economic stimulus introduced by the government, as well as lenders’ assistance packages.

Daniel Carde, general manager distribution, Resimac

“Specialist lending is countercyclical, so when the economy slows, borrowing in the product class picks up. Given this, we expect to see an uptick in specialist lending as the ongoing economic implications of the pandemic begin to take hold,” Carde says.

“For lenders willing to invest in technology the pandemic has provided an opportunity for innovation. For Resimac, COVID-19 motivated us to fast-track solutions that we’d been working on for some time, such as our digital document delivery system and remote ID verification, which has enabled us to provide a full end-to-end digital solution for brokers. It’s also demonstrated the strength of our processes. Throughout the pandemic we’ve been able to maintain turnaround times, while volumes have remained strong.”

This is also the ideal time for brokers who haven’t yet dipped a toe into the specialist lending pool to consider adding this to their product suite, says Mohnacheff.

“If a broker has not yet delved into specialist lending, now is the perfect time. With an increased need for more tailored solutions, having these custom offerings is going to help you build your business and help more customers. Liberty has the largest BDM team of all non-banks, eager to assist any broker through their first – or even just a particularly tricky – loan scenario. Brokers also have direct access to our team of underwriters, so they can have the confidence that any scenario will be responded to swiftly,” he says.

“There has been an uptick in debt consolidation and growth in self-employed applications in certain sectors as borrowers take the opportunity to review their lending requirements” Daniel Carde, general manager distribution, Resimac

Looking ahead at the next six to 12 months, it’s impossible to predict how the mortgage market will evolve, and Cory Bannister admits that it will “present challenges for many, particularly in relation to their finances”.

“But we know that Australians are incredibly resilient and often just need someone to lend a hand through difficult periods. This is where we anticipate a further increase in demand for specialist lenders,” he says.

“It is unlikely that major banks will reverse their long-term ‘simplification’ trend that has seen them focus on ‘vanilla’ home loan borrowers. For clients that have been directly or indirectly impacted by the COVID-19 pandemic, they will need to seek the support of a specialist lender who will take the time to fully understand their unique position and provide an appropriate tailored solution to meet their objectives and requirements.”

Carde adds, “The pandemic is ongoing for many Australians; however, lenders are still lending. We’ve seen lenders take different approaches, and as government stimulus is amended and potentially withdrawn we will see credit policies continue to evolve. We could see banks and non-banks extend hardship measures to customers if the impacts of COVID-19 continue for a longer period, putting individuals and small businesses under more pressure. Whatever lies ahead, our case-by-case common-sense approach will continue to allow us to quickly respond to any changes.”