By

The CEO of PLAN Australia, Anja Pannek, explains why partnerships are a core component of the aggregator’s business model, and how strategic goal-setting can transform broker and customer outcomes

For brokers, the ability to put customers first in order to drive outcomes and satisfaction is an essential part of business and a cornerstone of the findings of the Combined Industry Forum. For aggregators, the development, progression and ultimate success of brokers is crucial.

Adopting the tagline ‘Your partner in progress’, PLAN Australia knows about the importance of teamwork in achieving outcomes, and although the business is built on three pillars – vision, partnership and transformation – it is partnership that drives operations.

“What we have learned from talking to our brokers and members is that the thing they value most is partnership and how we work together to achieve outcomes for them,” says CEO Anja Pannek.

PLAN has one of the largest partnership manager workforces, with 21 PMs across all states providing personalised support and business advice.

“Partnership is key, and there are many elements to how you run a partnership: we are both in it together, we want to see our members succeed, we are in it for the long term,” Pannek adds.

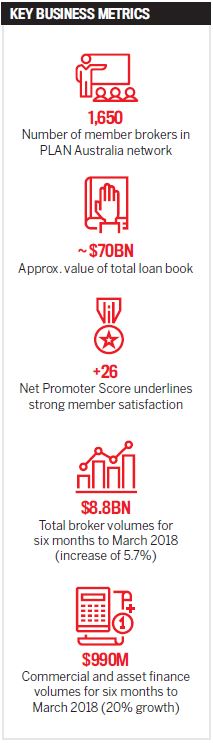

In partnering with brokers to achieve these goals, PLAN has grown to become one of Australia’s largest aggregator groups, boasting a network of 1,650 member brokers. In the six months to the end of March 2018, broker originations increased 5.7%.

With a total loan book value close to $70bn, the aggregator has also seen an uplift of 20% in commercial and asset finance volumes, reaching $990m over the same period.

“As a business, one of the things we have been talking about recently is what a successful broker is and what a successful broker will be in the future,” Pannek says.

As a result of those conversations Pannek and her team identified four criteria, dubbed the four C’s: customer first, compliance focused, commercially oriented, and committed to the industry.

“The concept of the four C’s is something we will be talking about much more into the future,” Pannek says.

While some appear self-explanatory, each element is part of the holistic approach to driving outcomes, regardless of how much regulation exists. At PLAN, compliance is a springboard for exploring how the industry could adapt in the future and what brokers will need to do to keep ahead of those changes.

As Pannek explains, “In my mind, legal requirements are really just a minimum standard when it comes to running a successful broking business.

“Compliance should be at the forefront for everyone, and what we know is that successful brokers always put their customers first. That’s what we see in our membership base. Customer-centricity is so important in the broking industry and will continue to be into the future,” she says.

Professional development is a key component of PLAN’s broker support strategy and has received a significant boost over recent months – not to mention multiple awards.

This year, PLAN’s national, face-to-face professional development series was turned on its head, according to Pannek, to drive higher engagement and stronger outcomes for participants.

“People’s time is very valuable, so as part of our focus for 2018 we really wanted to deliver content that is relevant to our members so that they could walk away immediately and say, ‘Yes, I’ve got it,’” Pannek says.

Each broker was guided through the process of business – and succession – planning, encouraged to road-map their business aims and take time to think about aspirations, hurdles and goals.

“The feedback was that brokers understood the importance of planning, of sitting down and thinking about where they are going. Now we are using that as an opportunity to go back and re-engage with those members on how we can tailor and deliver content that really meets their needs,” Pannek says.

Over in New Zealand, PLAN put a spin on its annual high-performers conference, providing the opportunity for a delegation of Australian brokers to experience the contrasts and complementary features of both markets. The brokers also had a chance to participate in a business simulation delivered in collaboration with business growth and start-up incubator The Icehouse.

“It was a lot of fun, very engaging, and it opened our eyes to a real demand for development and education that opens people’s thinking not only as brokers but as business operators.”

Taking brokers further afield, last year PLAN offered them the chance to study on a six-month strategic leadership program, inclusive of a week-long visit to Stanford University in California, hosted in early 2018.

During the trip the brokers attended the Stanford Graduate School of Business and heard from experts across the finance industry. The curriculum covered business innovation, strategies for scaling a growing business, and effective leadership. Back in Australia, the participants also visited successful businesses to see the program concepts in practice.

Described by Pannek as a “standout moment” of the last year, the scheme will repeat in 2019, offering another opportunity for brokers to forge ahead with their professional goals.

“We think there is real demand for education at that level, so we have made it very accessible for people to attend a world-class university that typically would be very hard to access. It was an incredible experience and one I think is very timely for brokers in this market,” she says.

Celebrating the aggregator’s 20th anniversary in 2019, PLAN – and Pannek – have many developments in the pipeline, as a result of both organic growth and the continued development opportunities provided for brokers.

“We have continued to see growth in our membership and aggregate lending, measured across both commercial and residential, year-on-year. In terms of supporting brokers to deliver a holistic customer offering, commercial has been a huge success for us. Year-on-year we are up about 20%, and the residential part of our portfolio has traditionally grown above system for the last few years,” Pannek says.

In a challenging environment, brokers now find themselves competing with each other and going head to head with their peers in order to stand out to their customers, adding an element of competition that didn’t exist previously.

Challenging brokers to identify how they stand out, as well as helping them to tap PLAN’s extensive networks in accounting, real estate, property and key referral sources, Pannek advises all brokers to formulate – and stick to – a business plan.

“It’s incredibly powerful for all individuals, regardless of size or scale of business, to be very clear on their goals. If you don’t write it down, you’re not going to get there,” she says.

Almost two years into the role, Pannek’s own road map for PLAN includes supporting brokers in navigating the industry at a time of “tremendous change”, facilitating development, diversification and, above all, the four C’s.

She says, “The last C is around commitment to the industry. Our industry is an important one, and it will continue to morph and change over time. Brokers have a big role to play in delivering good customer outcomes, and, as an aggregator, our role is to support our members in doing that.”