Best Business Development Managers in Australia | 5-Star BDMs

Jump to winners | Jump to methodology

Driving success for brokers

BDMs are in demand more than ever due to the ongoing economic challenges across the industry.

Australian Broker’s 5-Star BDMs 2024 are those standout operators who’ve gone beyond simply dealing with issues; they are solving problems, creating solutions and acting as trusted advisers to brokers nationwide.

It was the broking community that voted for the best business development managers, with some commenting on what truly moves the needle:

-

“Being an open line of communication and support and being open to working together to find solutions.”

-

“Understand more of what the business’ long-term goals are. Check-in on a frequent basis to remind them of the types of services they can provide.”

-

“Commit to being there, taking a call for guidance and having product knowledge to assist in finding immediate solutions when required.”

-

“Actually, return calls. Of the four major banks, two of them don’t.”

-

“By being easy to deal with and willing to get their hands dirty.”

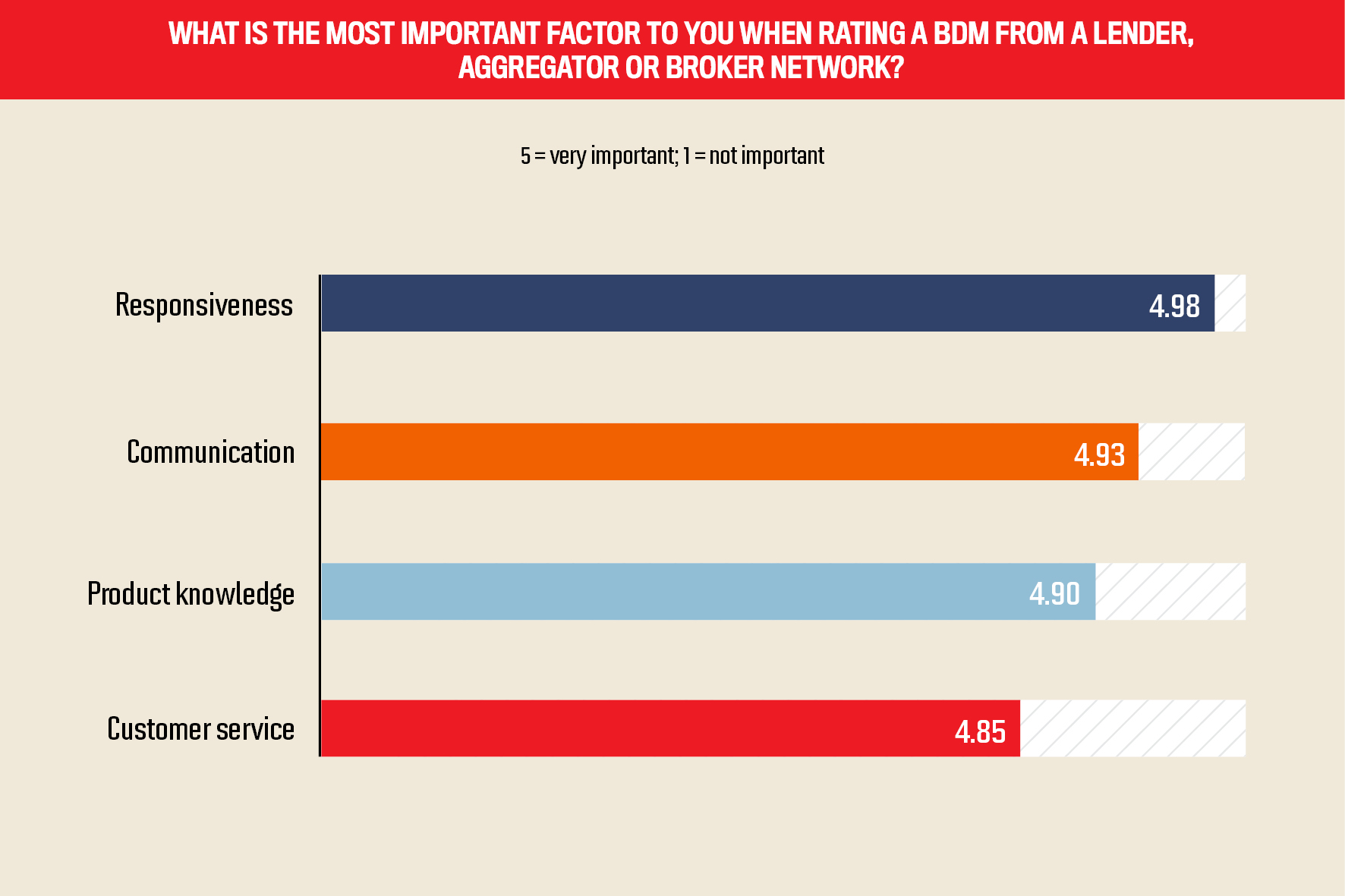

The 5-Star BDMs were rated across four key criteria. AB spoke to two winners – Marcus O’Brien of Specialist Finance Group and Auswide Bank’s Vicki Manaras – to understand why they stood out.

Responsiveness

It might appear simple, but it’s Australia’s brokers biggest priority when dealing with BDMs.

O’Brien says, “Unless I’m on another call, I always take a call coming in; I try to avoid it going to the message box. I’m very organised in the way I structure my day; I do emails in blocks. The thing for me is that when there’s no response, that’s when people tend to get agitated. Being in a management role is about being available for people when they need you.”

However, the caveat is that responsiveness has to be appropriate. O’Brien doesn’t rush when he needs more time.

“Not that I want all the problems to land on my desk every day, but if they do come through, it may be a problem that I’ve already fixed before. So, I know the answer or how to go about it,” he says. “Sometimes there’s complex scenarios that could be completely out of the box, so you’ve got to take a breath or put a bit of strategy around them. I’ll tell them, ‘Give me 24 hours, and I’ll take it away.’ Not everything has to be done in the heat of the moment.”

Manaras is another who always seems to be reachable. Often, during online team meetings, if a broker calls, she’ll quickly reply by text, reminding them to send an email.

She says, “If it’s quick, I’ll answer. If I need to speak to them about it, I’ll message them to tell them, ‘I’ll call you back.’ I’ve trained a lot of my brokers to know that if you can’t get me on the phone, pop me an email because a lot of them just want an answer as quickly as possible.

“If I don’t call back, they know I must be sick or something like that. We pride ourselves on getting back to our people as quickly as possible, giving them the answers they want so we can move on to the next thing for them.”

Customer service

Simplicity is often the most effective means of doing something.

Manaras says, “My customer service is my brokers, and behind the broker is the client.”

This appreciation has been harnessed by her 30-odd year career in customer facing roles.

“Getting a good result for my broker gives them repeat business, but I also hit my targets,” says Manaras. “The idea of service is really important to me because not only will it give me repeat business, but I also have brokers referring other brokers. At the end of the day, as BDMs, we’ve got to understand the client wants everything yesterday.”

Similarly, O’Brien never loses sight of the basics.

He says, “We’re in a people business; it’s all about being client- or broker-facing. I enjoy helping brokers; that’s where I get my satisfaction from.”

A significant part of his customer service efforts is spent on onboarding new brokers into Specialist Finance Group’s ways of doing things.

Marcus O’BrienSpecialist Finance Group

“It’s the old 80/20 rule, more time and effort are required when they join, whether it’s accreditation, software training, compliance training, commission or lending assistance. There’s a lot more time invested in the initial recruiting and meetings to build that rapport,” O’Brien says.

An attribute that has enabled O’Brien to be recognised as a 5-Star BDM is a lack of ego.

He says, “The brokers are self-employed business owners in their own right even though they’re under an aggregator, so my role is to provide support and direct them to the right person or department. Sometimes they just want to use me as a sounding board; I’m there for whatever role they need.”

Communication

Everyone has their own style of making contact. For O’Brien, it’s about being on the front foot.

“Sitting at a computer and doing emails all day is not my number one forte, whereas using my knowledge and having a conversation with brokers, either over the phone or face to face is what I prioritise,” he says. “I find that over the years we’ve had proven success when I engage with people and we can actually be in the same room or across the desk, as you can actually build rapport. I just think it’s more of a personal touch, and that’s genuine for me, so I prefer it, but I’m also a realist and know that in this day and age I have to do what I call blended delivery.”

As a result of Sydney’s notorious traffic, Manaras does local meetings to prevent her brokers from spending hours in a jam to meet her.

She says, “We get them together; we can get up to 20 brokers, and we go through all of our information, and if anyone wants to stay back and discuss a few things, then I do that.”

Even with her group meetings, Manaras is still content to offer one on one if needed.

“We keep that for when someone needs help with a deal, they don’t know how to submit it or they want us to meet the team,” she says.

Product knowledge

Having a particularly in-depth understanding of the ins and outs of Auswide Bank’s products enables Manaras to be responsive, offer great service and lessen the need for extra communication with brokers.

She says, “We’ve got two products. There’s a basic where the rate is cheaper, no offset and the other is a package, and sometimes we’ll have special offers.”

Manaras can list fees and structures at the click of a finger, but it goes beyond this by preparing material brokers can share with clients.

Vicki ManarasAuswide Bank

“We package things up for them to send them to their customers. Even though they do their research, they still come to me anyway because they like the way I package it for their client,” she says.

But it’s Manaras’ attention to detail that truly makes her a 5-Star BDM. She workshops every deal and documents all the communication, so the bank’s analysts can see her involvement and how everything connects together.

She says, “The brokers don’t have to repeat themselves. There’s no point in submitting the deal and hoping for the best. I prefer not to waste their time. I’ve taught them to have a chat with me, and if I feel it’s a deal, then we go to the next step and cover every base. I think that’s why I’ve been so successful.”

Being a sponge has served O’Brien well, and he admits to still learning, despite having almost four decades of experience in the financial industry. He is another who has product knowledge at his fingertips.

“Where does my knowledge come from? I feel that if you listen, learn and engage, then your activity generates education,” he says. “We run professional development days, so I’m always learning things like, ‘What's the latest guidelines? What’s the latest knowledge? What’s the latest tip or trick? What’s the latest licensing requirement?’”

Best business development managers’ broker tips

O’Brien: “Be adaptable to change, embrace technology and use your systems and processes to automate any tasks that don’t need to be done manually. If you have a certain weakness, there are other people or services available as support. Brokers need to be reminded to stick to what their skill set is.”

Manaras: “The moment you get a customer, treat them with respect. And just like brokers call me and want a response, I tell them to do the same with their clients. Let them know not to panic and that we have all got the same outcome on our minds.”

Best Business Development Managers in Australia | 5-Star BDMs

- Aaron Barry-Davies

Finsure - Aine Dargan

Bankwest - Alan Comer

Westpac - Ali Hassan

ANZ - Andrew Oey

MA Money - Andrey Tabachnikov

Westpac - Anil Keskin

St.George Bank - Aysun Portoglou

ubank - Bettina Lumsden

Pepper Money ANZ - Brijesh Mehta

Well Nigh - Chloe Savanah

Pepper - Craig Nicholas

Resimac - Daisy Yu

Finsure - David Tickle

Pepper Money ANZ - Daz Smith

Suncorp - Elyvin Maharaj

Macquarie Bank - Emmanuel Makroglou

ANZ - Emoke Palos

Resi - Felicity Wu

Finsure - George Markos

ANZ - Giselle Stellenberg

HSBC - Giuseppe Picello

Suncorp - Greg Durie

Pepper Money ANZ - Helen Bozikis

Bankwest - Herry Tjandrasusilo

Bank Australia - Jason McDonald

ANZ - Jay Allen

Brighten - Jerome Porcia

Resi Home Loans - Jimmy Hou

Brighten - Jodie Hanson

Pepper Money ANZ - Josh Bittencourt

Pepper Money ANZ - Julia Cosentino

Bankwest - Kathryn Mortimer

Pepper Money ANZ - Katie McNamara

La Trobe Financial - Kay Yang

Brighten - Kylie McCue

Pepper Money ANZ - Linda Fraser

Pepper Money ANZ - Maddie Matthews

Fintelligence - Malcolm Elias

Macquarie Bank - Melanie de Jager

MA Money - Michael Petidis

ANZ - Nancy Chu

ANZ - Natasha Paszyn

Plenti - Nicholas Brookes

ING Australia - Omar Ibrahim

St.George Bank - Peter Jong

Finsure - Roohi Kumar

St.George Bank - Sam Tang

Westpac - Samantha Kyriakidis

Pepper Money ANZ - Sevim Isikli

Finsure - Simon Naidu

Great Southern Bank - Sornkin Sairlao

ANZ - Tes Anderson

Bankwest - Van Vu

Finsure - Wendy Goulevitch

Brighten - Zane Young

ubank

Methodology

In February, Australian Broker carried out extensive research to determine Australia’s top business development managers for the fourth annual 5-Star BDMs award. AB researchers began by conducting a survey with a wide range of brokers. The team contacted hundreds of brokers across the nation and, through in-depth phone interviews, encouraged brokers to identify the top-performing BDMs. Brokers were asked to name the BDMs who gave them the best support based on four criteria: customer service, responsiveness, communication and product knowledge. From over 1000 nominations, the list was whittled down to 180 BDMs, with 60 individuals who were rated excellent across all categories receiving 5-Star awards.

Keep up with the latest news and events

Join our mailing list, it’s free!