5-Star Banks

Jump to winners|Jump to methodology | View PDF

BROKERS A KEY DRIVER OF BANKS’ SUCCESS

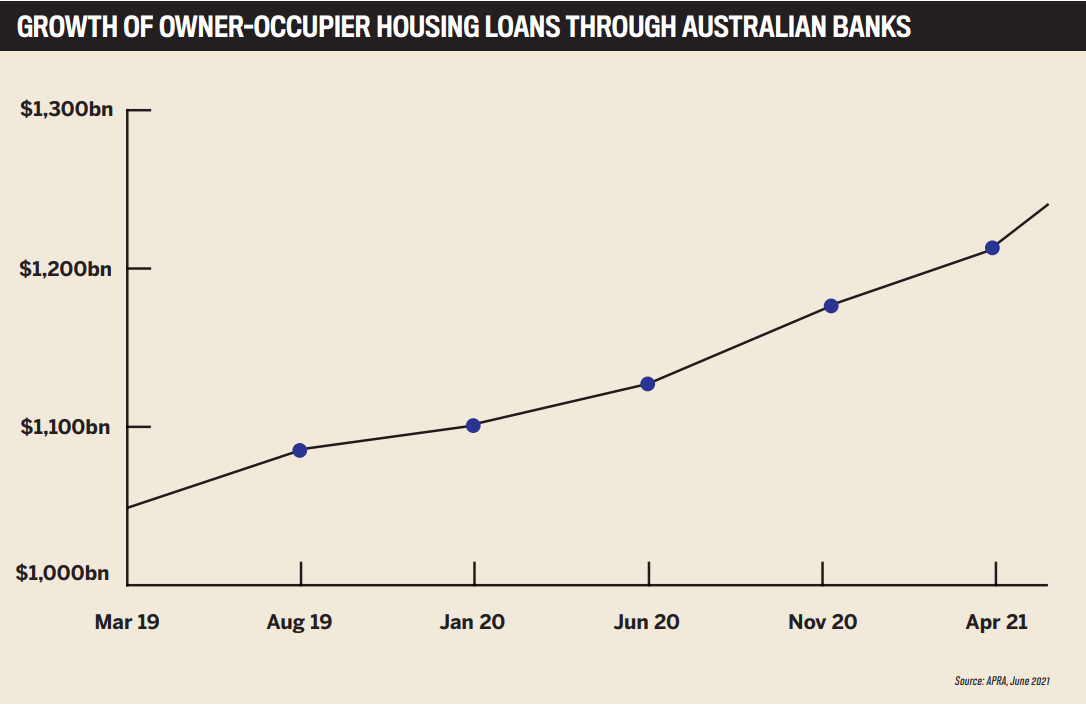

Despite ongoing COVID-19 lockdowns and restrictions affecting almost every facet of life in Australia, the appetite for property remains high.

Whether this is driven by treechangers or seachangers moving out of the major cities, first home owners taking advantage of government incentives to buy their dream home, or families renovating or refinancing to make the most of low interest rates, banks and brokers are benefiting from clients seeking property finance solutions.

This massive demand for loans has overwhelmed some lenders and led to long turnaround times and channel conflict with brokers.

But those banks that have had the support infrastructure and technology in place and, more importantly, great relationships with their brokers, have succeeded in avoiding these problems and enjoyed impressive loan volume growth through the broker channel.

Banks realise the importance of brokers in bringing residential and commercial finance business their way.

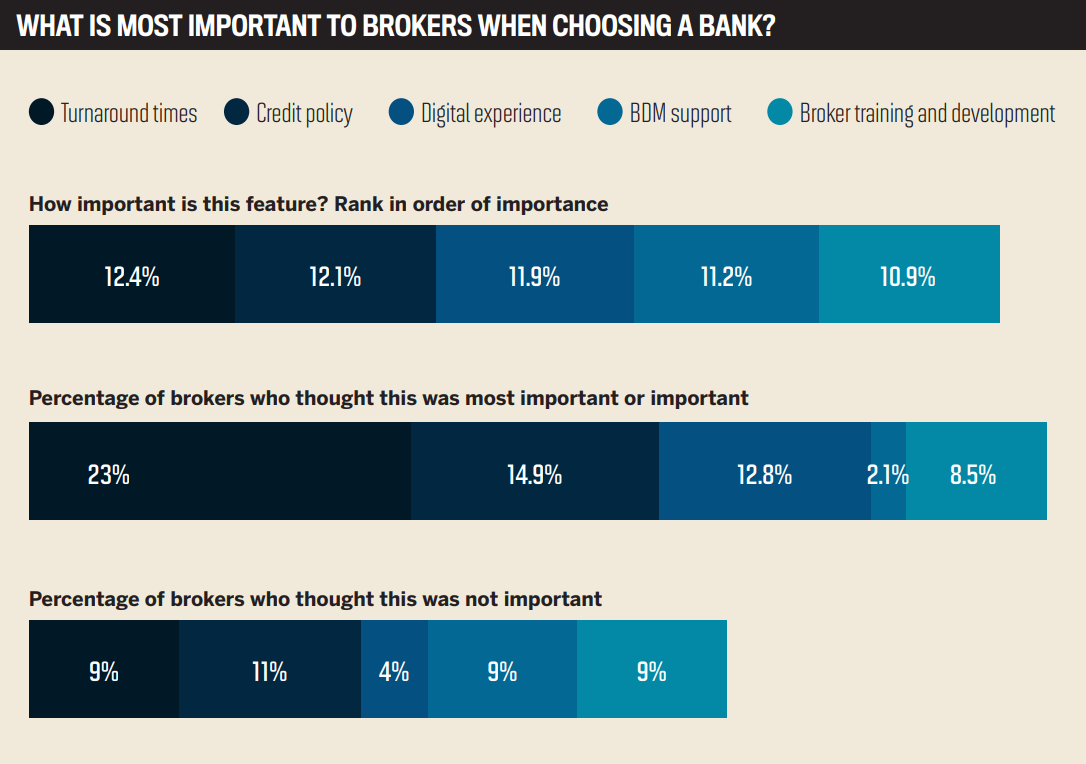

Australian Broker surveyed more than 400 brokers across the country to gauge their views on Australia’s banks for the 2021 5-Star Awards. Brokers were asked to determine what features in a bank were most important to them.

The brokers were then asked to rate banks across nine criteria – product range, interest rates, broker communication, commissions, broker training and development, BDM support, digital experience, credit policy and turnaround times.

Brokers picked four banks as the best in the industry, which achieved more than 80% ratings across all criteria. The four banks winning a 5-Star Award this year are Adelaide Bank, Bankwest, Macquarie Bank and ING.

Adelaide Bank head of broker distribution Raj Kapoor says it is a great honour to receive the award in a unique and challenging year.

“This award is testament to the hard work of our fantastic and growing BDM, back-office and support teams; without whose efforts, this wouldn’t be possible,” Kapoor says.

“As a dedicated broker-only bank, the broker channel is key to our current and future long-term success.”

“Our strategy in the broker channel has always been to provide personal service to our brokers, and being a smaller player in the market gives us a nimbleness and a more responsive approach to broker feedback and to meeting their needs as they grow their businesses.”

Kapoor says Adelaide Bank has had had an incredibly successful year in the broker channel, with almost 50% growth in applications and approvals year-on-year.

“Our focus in the coming 12 months is to continue to build on this momentum by further cementing the strong relationships we have formed with our broker partners and continuously improving our processes by providing a compelling broker value proposition. It’s a simple strategy, and we’re running hard with it.”

Ian Rakhit, Bankwest’s general manager third party, says for Bankwest be rated so highly by brokers means a great deal to him and his colleagues.

“We’re incredibly proud to receive this accolade from the broker community,” Rakhit says.

“We’re determined to deliver brilliant customer experiences every day, and we know many people prefer the support of brokers in making one of the biggest financial decisions of their lives.”

Rakhit says Bankwest believes in brokers so much that 80% of its home loans originate through the bank’s 12,000 accredited brokers.

“Bankwest strives to be the best broker bank in the country … we believe the best way to achieve that is by listening to brokers; delivering what they need and want.”

Bankwest operates a case ownership model, with one point of contact throughout the application process, in order to be as efficient for its brokers as possible.

The bank enjoyed a significant increase in home loan applications in the past 12 months, including record volumes in March, April and May.

Rakhit says to help meet demand Bankwest has reverted to pre-pandemic lending of up to 98% LVR (inclusive of LMI) for owner-occupier purchase and construction applications.

Wendy Brown, head of broker sales at Macquarie Bank, says Macquarie is thrilled to receive a 5-Star Award.

“We’ve been working really hard behind the scenes to deliver a seamless experience when it comes to the home loan application process, so winning awards like this means our efforts are resonating with brokers.”

Brown says Macquarie Bank is committed to the broker channel, so to know brokers rated the bank among the best in key focus areas, such as turnaround times, digital experience and BDM support, is very rewarding.

“We’ve made big investments in these areas in recent years,” she says. Macquarie Bank provides brokers with regular updates on the latest policy and industry changes, as well as weekly emails on processing times. Brown says broker feedback is also important.

“We do everything we can to action it, all with a view to making it easier to do business with us.”

Macquarie Bank was pleased with the growth in its home loan portfolio, seeing the benefits of significant investments in its mortgage platform, market-leading product and turnaround times.

“We’re also proud to have built a leading digital experience, and we’re always investing in our digital capabilities to meet the needs of brokers and their clients.”

Glenn Gibson, acting head of retail bank at ING, says the bank is experiencing sustained growth through its broker channel as a direct result of its service, products and price proposition.

The 5-Star Award is of significant importance to ING because brokers are such a key pillar in helping it maintain an excellent customer experience.

“This ultimately means brokers believe we’re going above and beyond to help their client/our customer, and this is what matters most,” Gibson says.

“The broker channel to us is of utmost importance. As a digital bank we don’t have branches, so around 80% of our home loan business comes via the broker channel.

“We maintain strong relationships with our brokers by listening and acting quickly on what brokers are telling us. Our ability to maintain a turnaround time of less than three days for the past two years is testament to this.”

5-Star Excellence Awards

- Adelaide Bank

- Bankwest

- Macquarie Bank

- ING

Methodology

Banks are always looking for an edge over their rivals. And they only need to look at the broker channel. MFAA figures released in June 2021 showed that the mortgage broker market share rose 27% in a year. In the first quarter of the year, brokers enjoyed market share of 57.5%. Banks are increasingly reliant on the broker channel to drive higher volumes.

Brokers will be drawn to banks that have great rates and product ranges, quick turnaround times, clear credit policies, and good technology and communication. Now extensive market research has revealed brokers’ best banks.

Australian Broker surveyed more than 400 brokers across Australia to understand what brokers think of current market offerings and bank/broker relationships. Brokers were quizzed on their most preferred bank and asked to rate them on broker communication, training and development of brokers, BDM support, product range, interest rates, credit policy, turnaround times, digital experience and commissions. A number of banks were identified, and they all received ratings above 80% for commissions, credit policies and turnaround times. The 5-Star Bank Awards were presented to the four banks that achieved more than 80% ratings across all nine criteria.

Keep up with the latest news and events

Join our mailing list, it’s free!