Tighter lending to investors is expected to lead to a softer residential property market, according to QBE’s Australian Housing Outlook 2016–2019.

The report, prepared by BIS Shrapnel, examined the housing market as of June 2016 and provided forecasts for the next three years until June 2017.

In Sydney, house prices are expected to remain flat during this three-year period while apartment prices are predicted to fall 6.8% cumulatively. In Melbourne, house prices are forecast to decline by 0.6% while units are expected to drop by 9%.

Brisbane will experience the most varied property market over the next three years with QBE predicting house prices will rise by 6.5% while apartment prices drop by 8.2%.

Over the big three capital cities, median house prices for June 2015, June 2016 and the predicted median house price for June 2019 can be found below:

| |

June 2015 |

June 2016 |

June 2019 (est) |

| Sydney |

$1,034,100 |

$1,047,600 |

$1,050,000 |

| Melbourne |

$734,300 |

$774,300 |

$770,000 |

| Brisbane |

$507,800 |

$525,700 |

$560,000 |

For apartments, the figures are as follows:

| |

June 2015 |

June 2016 |

June 2019 (est) |

| Sydney |

$705,800 |

$729,800 |

$680,000 |

| Melbourne |

$515,400 |

$527,300 |

$480,000 |

| Brisbane |

$420,300 |

$424,700 |

$390,000 |

“With supply now reaching a level commensurate with population growth, there are signs that the Sydney and Melbourne markets may have peaked, with price growth easing back to the levels of the other capital cities,” the report said.

Due to the ongoing surge in dwelling completions around the country, there is limited scope for significant price rises from now to 2018/19. Instead, prices may decline in a number of markets – which will mostly be relegated to apartments.

“It’s a fascinating time to be looking at the Australian residential property and mortgage market,” said Phil White, CEO of QBE Lenders’ Mortgage Insurance.

“Prices are forecast to soften through the three years to 2019, which is likely to be positive for housing affordability.”

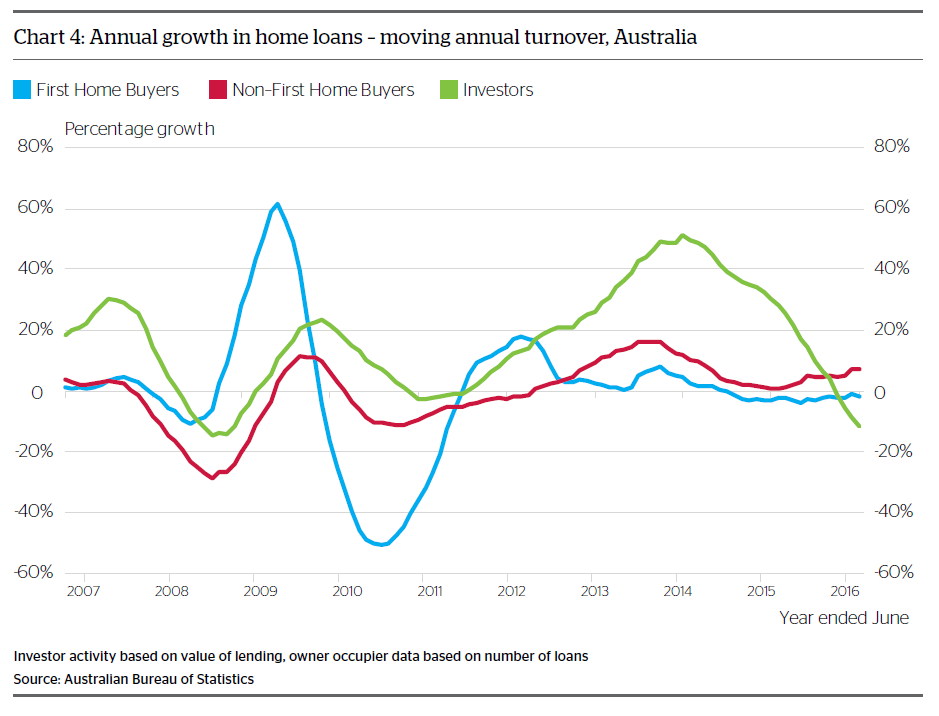

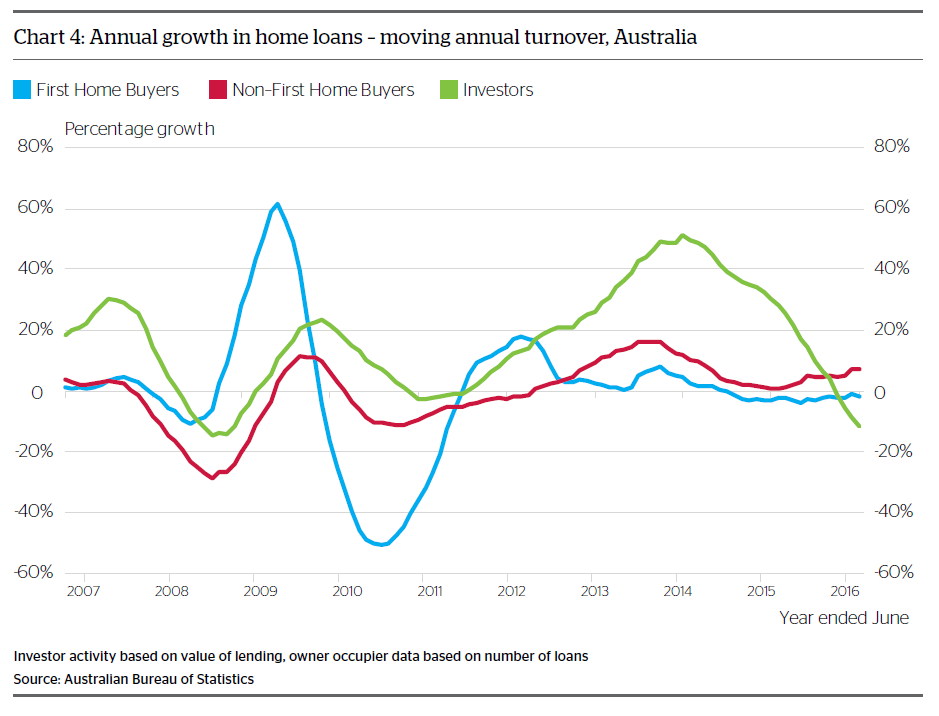

Thanks to tighter lending criteria, fewer investors were now entering the market, according to the report. In 2015/16, 44% of all residential loans were taken out by investors. This was down from 51% in 2014/15.

“It’s expected owner occupiers, including first home buyers, will be stepping in to pick up some of this opportunity in the market,” White said.