Non-major bank Suncorp has announced lending restrictions on certain postcodes within the Brisbane metro and CBD area.

The new policy, which comes into effect on Monday 23 October, means that new investment home lending applications will no longer be accepted within the designated areas for apartments with an LVR of over 80%.

Risk settings have been adjusted for these postcodes based on weaknesses within Brisbane’s investment unit market which point to a reduction in prices, the bank said in a broker note released on Monday (16 October).

This is a “reasonably minor adjustment” to the bank’s risk settings, a Suncorp spokesperson told

Australian Broker.

“We are continuing to lend to investors in these post codes who meet requirements. The vast majority of our investment lending in the apartment space is an LVR of 80% or below.”

Suncorp continually monitors the market and reviews its risk settings accordingly, the spokesperson said.

“The bank receives regular market updates from a variety of sources, as well as conducting in depth analysis of the broader lending market, sales, and new business data when considering these types of lending changes.”

Existing home loan customers, owner occupier borrowers, and applications received up until close of business on Friday 20 October will not be affected by these changes.

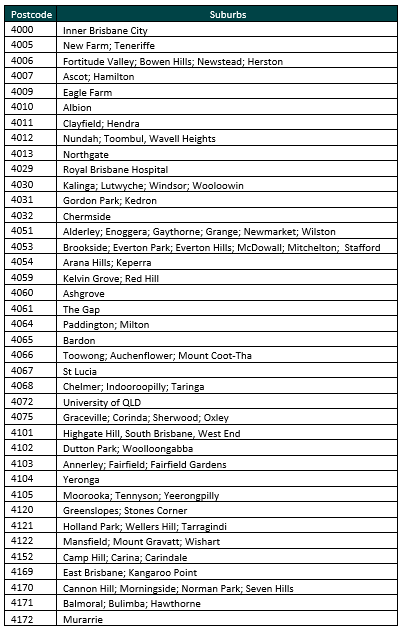

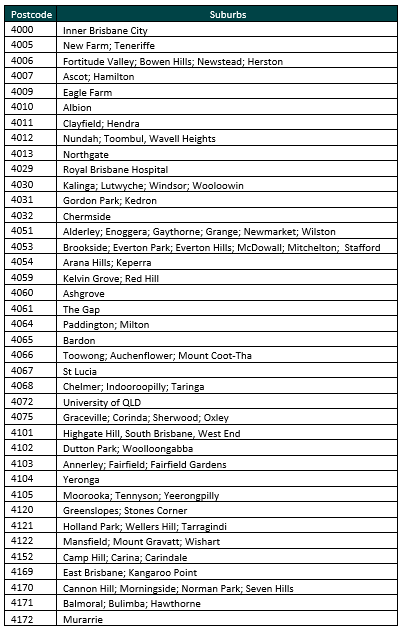

The following postcodes have been targeted by Suncorp's lending restrictions:

Related stories:

Major bank restricts lending in select postcodes

BOQ broker network expands to over 7,500

Non-major grows broker loans by $400m

Related stories:

Major bank restricts lending in select postcodes

BOQ broker network expands to over 7,500

Non-major grows broker loans by $400m