Lower interest rates have meant that fewer investors are negatively gearing their properties, the latest data from the Australian Taxation Office (ATO) suggests.

In the 2014/15 financial year, 1.27 million Australians recorded a rental net loss – down slightly from the 1.3 million people recorded the year before. This figure means that 12.8% of taxpayers were negatively gearing in 2014/15.

The ATO also found that 12.8% of taxpayers declared a net rental loss in 2014/15 which was down from the peak of 13.4% in 2012/13. However, the number of people claiming a deduction of interest on rental properties increased from 1.59 million to 1.68 million in the same time period.

“You’ve got an increased number of landlords who have borrowed but who are positively geared. In other words, the running income of the property is higher than the interest that they’re paying,” John Daley, CEO of the Grattan Institute, told

Australian Broker.

The reason for this trend is that as interest rates fall and rents rise, more investors wind up moving from being negatively to positively geared, he said.

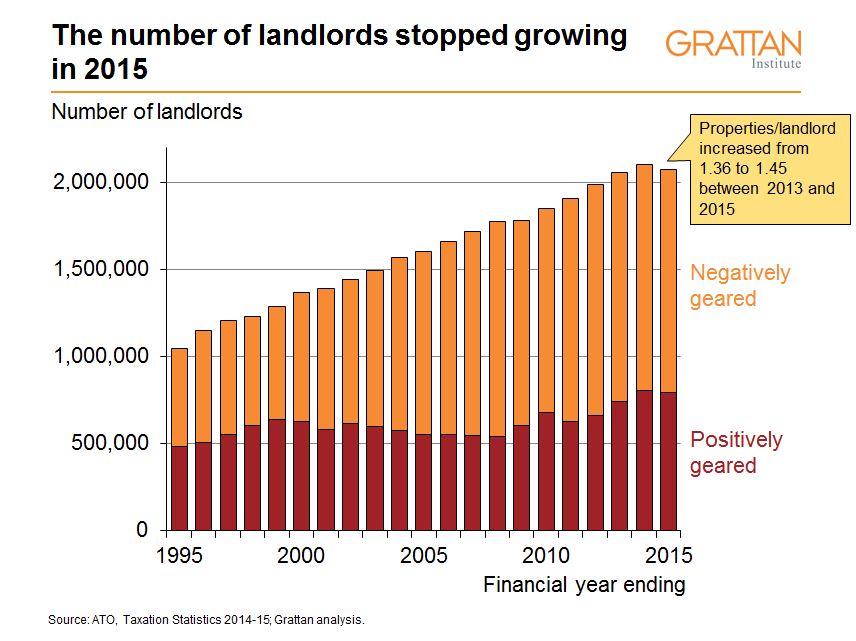

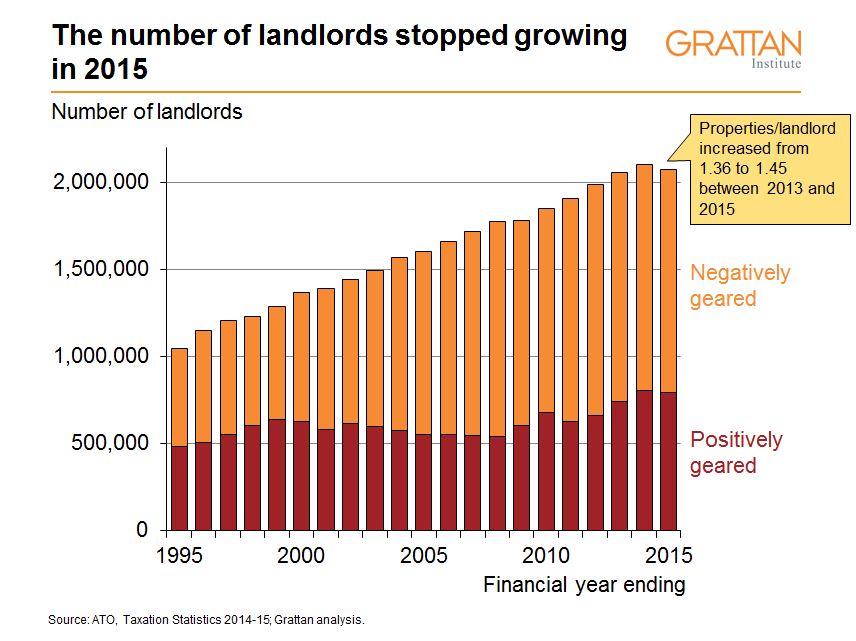

At the same time, the total number of landlords has fallen overall.

“The total number of investment properties has increased so the investor property market appears to have concentrated slightly. We’ve got slightly more properties per landlord amongst fewer landlords.”

While 71% of those earning income from rents own one property, there has been a 9.2% increase in the number of landlords owning five or more properties since the 2012/13 financial year.

“The average number of properties per landlord has also gone up,” Daley said.

Analysing occupation

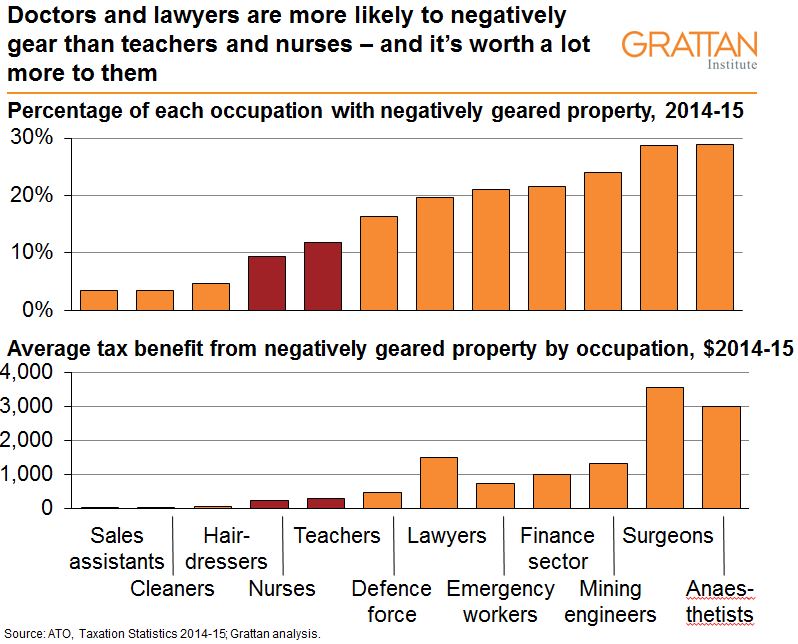

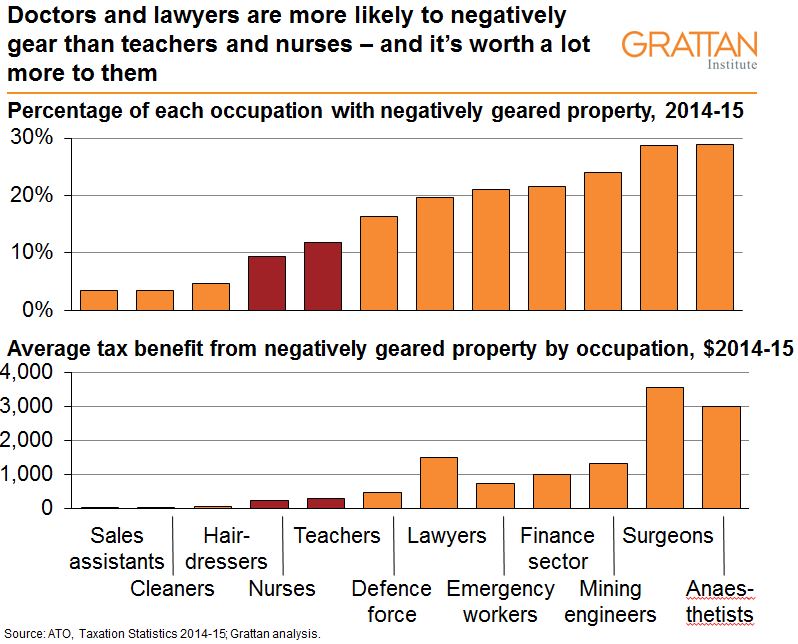

The ATO found that 29% of both surgeons and anaesthetists negatively geared their property compared to 21% of emergency workers, 20% of lawyers, 12% of teachers and 9% of nurses.

These results were totally consistent with what Grattan had seen previously, Daley said, mostly because occupations with higher incomes tended to negatively gear more.

“There does appear to be a bit of a skew with lawyers who not surprisingly are particularly likely to have higher incomes but who are a little bit less likely to negatively gear than you might expect for that income.”

However, lawyers tended to have higher material losses when they do negatively gear. “When they do it, they do it big,” Daley said.

On income brackets

The data also showed that although only 22.3% of individuals earned over $80,000 in taxable income, 40.3% of this tax bracket negatively geared with deductions equalling 49.5% of the total national rental loss.

When looking at these ATO statistics, it was important to note the figures take into account taxable income after any rental losses are removed, Daley said.

“This is the whole point of negative gearing – to make your income look lower than it is otherwise. That’s the idea.”

For more detailed data on what happened before claiming the deduction, Daley pointed to Grattan’s Hot Property Report released in April last year.

“If you look at it after claiming the rental deduction, something like 54% of all benefits from negative gearing go to the top 20% of income earners. But if you look it before they claim the rental deduction – in other words, what was their other, non-property income – something like 66% of the benefits go to the top 20%.”

In fact, those with a taxable income of over $80,000 are in the top 10% of taxpayers nationally, he said.

Related stories:

Lobby group calls for negative gearing reform

Negative gearing: Stopping the abuse

House prices soar under Coalition governments