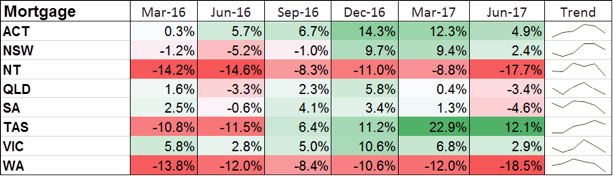

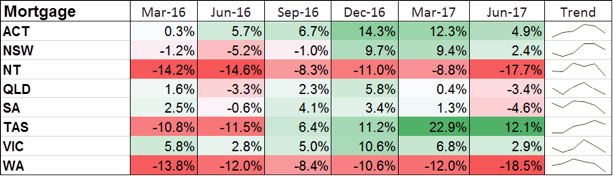

Mortgage applications during the June quarter have fallen by an annual rate of 0.9%, according to new research examining levels of consumer credit demand.

The latest data by global information solutions firm Equifax shows the number of residential loan applications easing across all states and territories – although some regions are still experiencing positive growth. The individual positive or negative movements for each state are as follows:

- Tasmania (+12.1%)

- ACT (+4.9%)

- Victoria (+2.9%)

- NSW (+2.4%)

- Queensland (-3.4%)

- SA (-4.6%)

- NT (-17.7%)

- WA (-18.5%)

“This is the second consecutive quarter of easing growth in mortgage applications, and the beginning of a downward trend across all states and territories,” said Angus Luffman, senior general manager of consumer products at Equifax.

“Any debate about whether the housing market is softening should now be put to rest, as we can clearly see that, even in the historically strong geographies on the eastern seaboard, mortgage application demand is slowing or already in decline.”

Movements in mortgage application demand data from Equifax precede house price movements by six to nine months and are an indicator of home buyer demand and housing turnover.

“The trend for mortgage demand would indicate more softness to come, mainly because there is consistent slowing of demand across all states,” Luffman told

Australian Broker.

Equifax also released its

Quarterly Consumer Credit Demand Index today (19 July), a report which looks at trends in credit cards and personal loans.

Overall levels of consumer credit demand increased by 10.3% in the June quarter. Most of this upward trend was driven by an 18.4% pick-up in personal loan applications while credit card applications only went up by 2.3%.

Related stories:

Victoria in line to beat NSW in property performance

Non-major market share breaks 35%

House price growth predictions fall to 0.6%

(1).jpg)