Recent trends in the property market have suggested that all may not be what it seems when it comes to investors reclassifying their loans as owner-occupier, according to one international bank.

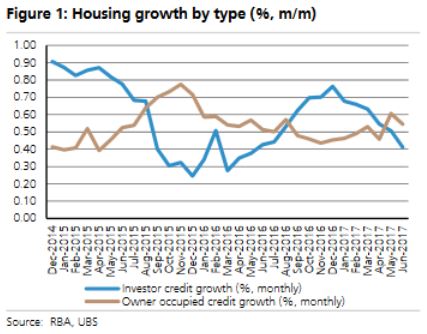

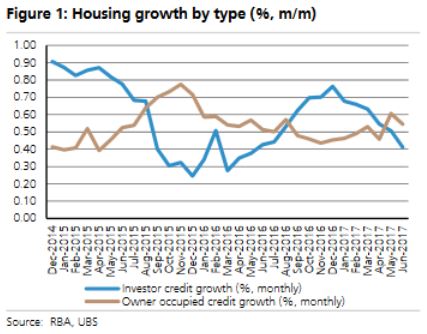

While investment property lending has slowed down from 0.76% in December to 0.41% in June, figures for actual lending have remained steady between 0.50% and 0.55% per month, said UBS analysts

Jonathan Mott and

Rachel Bentvelzen in a recent Australian banking sector update.

The update entitled

Are Owner Occupiers Filling the Investor Housing Gap? was released on Monday (31 July) and implied two possibilities:

- Owner occupier lending is filling the gap left by investors

- Some investment borrowers are telling their lender they intend to occupy their property to benefit from lower interest rates

Since first home buyer numbers are near record lows, the analysts said that for owner occupiers to be filling the gap, it would require a rapid uptick in the number of upgraders purchasing bigger homes.

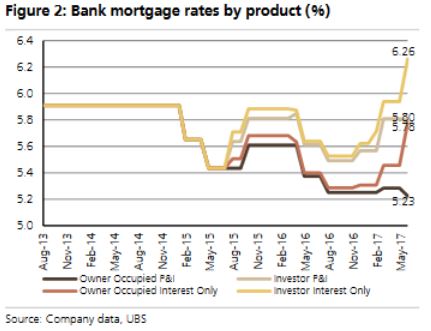

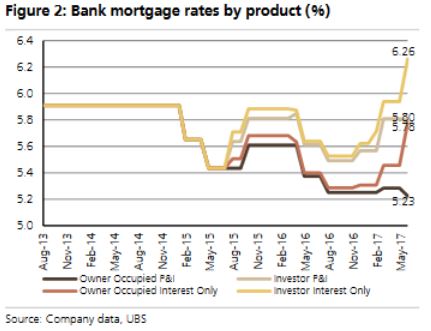

“While it is plausible that there has been an increase in upgraders, we would not be surprised if borrowers are tempted to apply for or re-classify themselves as owner occupiers given the almost 60 basis point differential in interest rate between owner occupier and investment property lending.”

This was consistent with figures from previous UBS research which found that 28% of mortgage holders in general and 32% of those using mortgage brokers said their application was not factually accurate, Mott and Bentvelzen said.

Related stories:

Loan reclassification questioned in $51bn switch

Investors to feel the pinch in property overshoot

Established dwellings preferred investment choice

Related stories:

Loan reclassification questioned in $51bn switch

Investors to feel the pinch in property overshoot

Established dwellings preferred investment choice