Housing and household consumption has been highlighted as one of the key areas of uncertainty with regards to accurately forecasting future economic trends.

In the Reserve Bank of Australia’s (

RBA’s) quarterly

Statement on Monetary Policy, the bank listed how developments in this area would affect the economy overall.

Echoing RBA governor

Philip Lowe’s speech yesterday (4 May), the statement warned that higher levels of household debt means that households are more sensitive to deterioration in expected income growth which could come from factors such as rising house prices.

“If indebted households believe that their prospects for income growth have weakened, they could choose to pay down debt faster and consumption growth could be lower than forecast.”

Although rising house prices in Sydney and Melbourne could see more spending and renovation activity in the short-term, continuation of this trend could result in further risks in the medium-term, the RBA said.

“The recent tightening in prudential standards and higher interest rates on some mortgage products are likely to weigh on credit growth, particularly for investors.

Investor activity is currently strong in Sydney and Melbourne, but history shows that sentiment can turn quickly, especially if prices start to fall.”

A weaker housing market would lead to slow consumption growth, lower levels of dwelling investment, and reduced levels of consumer price inflation.

Trends in domestic finance

Loan approvals have declined in recent months, driven by downward movement in Victoria while levels in New South Wales have stayed at record highs, the RBA said.

“Housing finance for new dwellings has been little changed recently following rapid growth through 2016; housing finance for the construction of new homes has remained stable.”

Loans for new dwellings or dwellings under construction are predicted to have accounted for over half of credit growth in the past year. This contribution is expected to increase further, linked to the pipeline of residential construction work currently underway.

The share of loan approvals at the major banks has dropped in recent months to its lowest levels since 2008, the RBA said, with most of this decrease being absorbed by other Australian and foreign-owned banks with a smaller percentage going to the non-bank lenders.

“Housing credit issued by entities that are not licensed by APRA as authorised deposit-taking institutions (ADIs) is estimated to have increased slightly in recent quarters, but at around 3% remains a very small share of housing credit.”

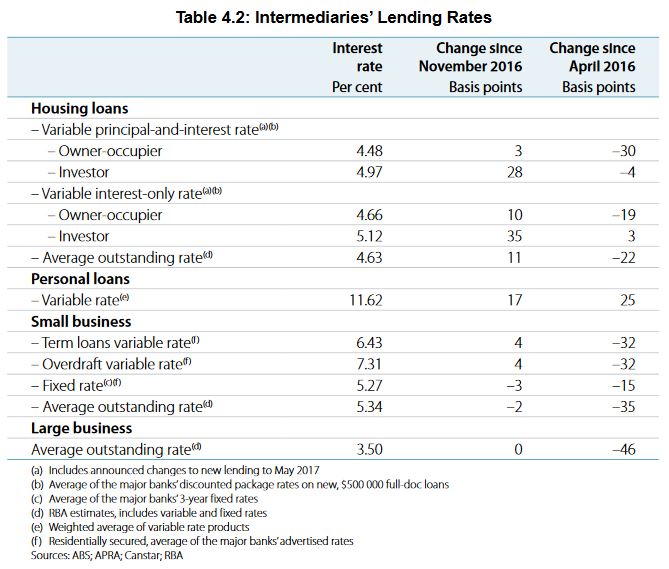

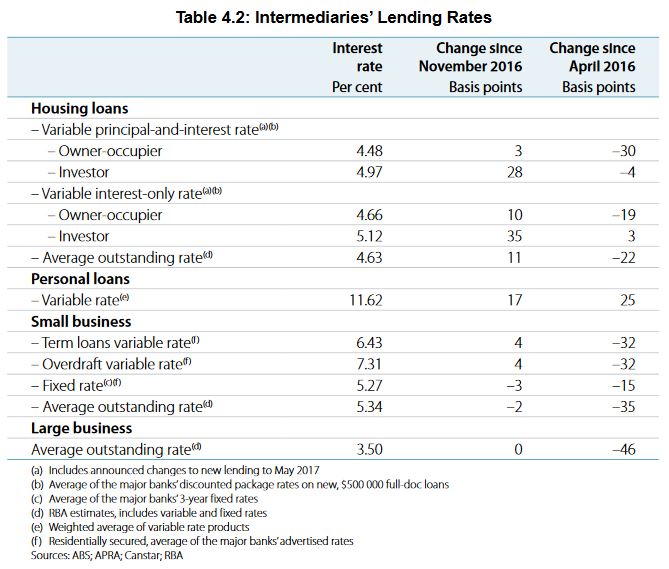

Out-of-cycle rate hikes by lenders in March and April as well as tighter guidelines from APRA and ASIC in the interest-only space are expected to affect housing growth credit in the near future.

“Since February, the major banks have announced an average cumulative increase to their standard variable rates of around 25 basis points for investors and a few basis points for owner-occupiers. Also, borrowers will pay an additional premium for interest-only loans of around 15 basis points for investors and 20 basis points for owner-occupiers.”

Related stories:

RBA warns on housing’s two-edged sword

APRA limits will curb mortgage risk: Moody’s

Tighter lending restrictions could backfire

Related stories:

RBA warns on housing’s two-edged sword

APRA limits will curb mortgage risk: Moody’s

Tighter lending restrictions could backfire