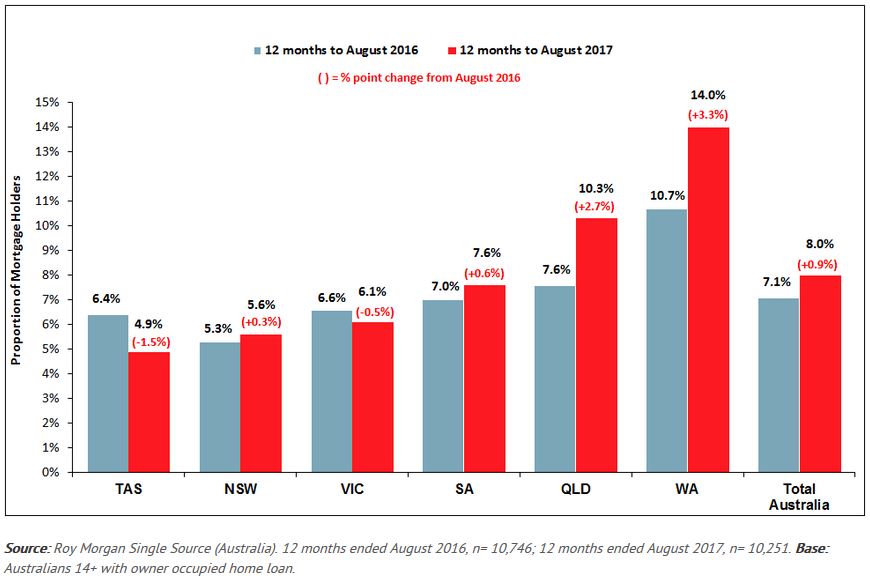

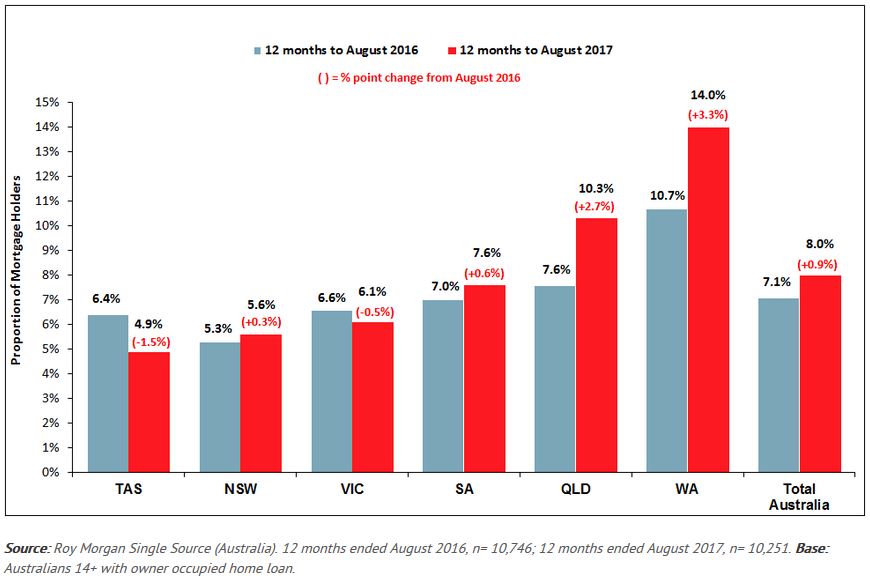

Around 345,000 (or 8%) of Australian mortgage holders have little to no real equity in their homes representing a “considerable risk” to the housing market and general economy, a new study by Roy Morgan has found.

Roy Morgan’s

Single Source Survey found that this current figure increased from 311,000 (or 7.1%) a year ago. The survey compiled data from interviews with over 10,000 owner-occupied mortgage holders.

“This represents a considerable risk, particularly if home values fall or households are hit by unemployment,” said Norman Morris, industry communications director at Roy Morgan Research.

Factors contributing to this mortgage stress could include borrowers maintain debt for other purposes instead of paying off their mortgages or the use of interest-only loans, he said.

“If home-loan rates rise, the problem would be likely to worsen as repayments would increase and home prices decline, with the potential to lower equity even further.”

Overall, those in Western Australia were most at risk with 71,000 (or 14%) having no real equity in their homes. At the other end of the spectrum, mortgage holders in Tasmania were at the lowest risk with only 4,000 (or 4.9%) having no equity in their homes.

Morris attributed WA’s higher numbers with the slowdown in the mining sector and a decrease in overall house prices.

“If house prices decline further in WA and unemployment increases then more mortgage holders will be facing a tough situation.”

The survey also found that those with little or no equity owned lower-value homes, reporting an average house value of $501,000 compared to the sum total of all mortgage holders at $761,000. This was split up across the states as follows:

| |

Average value for those with little or no equity |

Average value for all mortgage holders |

| NSW |

$623k |

$975k |

| Victoria |

$549k |

$804k |

| Australia |

$501k |

$761k |

| WA |

$466k |

$637k |

| Queensland |

$446k |

$569k |

| Tasmania |

$375k |

$392k |

| SA |

$339k |

$493k |