To stop the ever increasing levels of debt in Australia, one economist believes that there needs to be a hard reset of private debt levels via a “people’s quantitative easing”.

In an interview with the

Australian Financial Review, author and economist Steve Keen, outlined his two-step plan to reduce household debt from current levels of 120% to between 50 and 100%.

The first step involves banks using government cash injections that reduce account holders’ existing debt. Customers with no debt would receive cash.

Keen said this instalment would be a bit larger than the $1,000 stimulus Kevin Rudd offered in 2009.

“In anything like this, which hasn’t been tried before, I would want to do it in small doses,” he told the

AFR.

Radical yet simple reform of the banking sector would then be required, he said.

“What I want to do is bring in a range of bank rules which would limit the amount of lending you can give against an asset to some multiple of the income-earning capacity of the asset.”

For instance, banks could put a loan limit of $500,000 on an estimated annual rental income of $50,000. This ensures that the bidder for the house with the most savings who is more capable of handling the debt comes out as the winner.

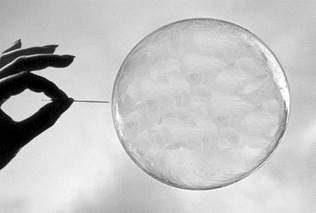

“I want to cut off the asset bubble lending. When you look at the empirical data, overwhelmingly it’s leverage that determines asset prices. You have this positive feedback loop between lending and asset prices and that’s how you get the bubbles we’ve got. These guys are making money by creating Ponzi schemes.”

Related stories:

“Big shakeouts” expected for Australian property

Will Trump mean doom for Aussie housing?

Property may become “the worst investment”