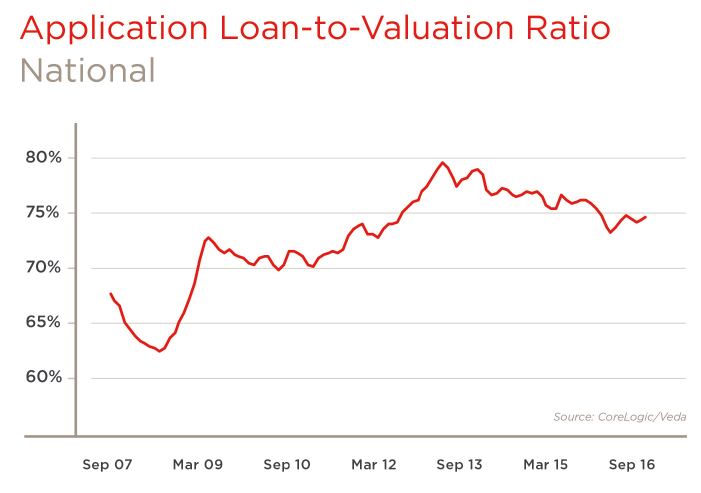

Australia’s national average application loan-to-valuation ratio (LVR) is now at 74.3%, significantly lower than the 2013 peak, according to a recently released property index.

Developed by property analytics and risk management firm

CoreLogic and consumer and commercial data analytics firm Veda, the index compares median dwelling values with median residential loan applications.

While the current LVR of 74.3% has trended upwards by 1.7 percentage points from 72.6% in 2011, it is lower than the 2013 peak of 78.9%.

“In the past 12 months to September, we have seen the national median dwelling valuation rise 5.5% and the median residential loan enquiry amount rise 3.4%,” said Moses Samaha, general manager of commercial and property solutions at Veda.

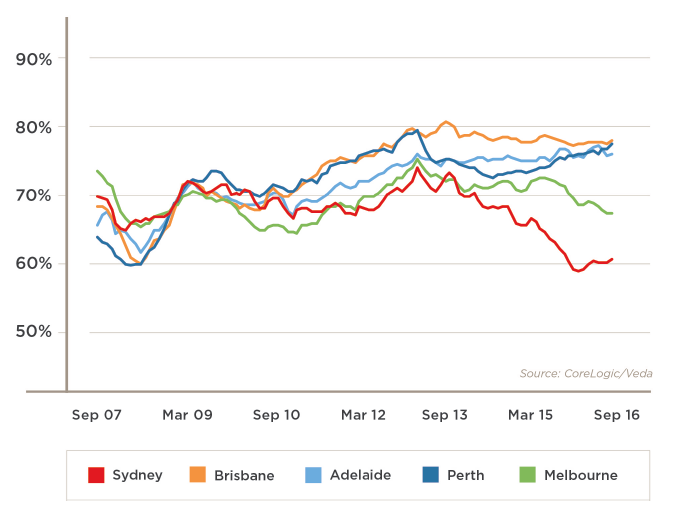

The average application LVR has been pushed downwards, driven by higher levels of equity and household wealth across the country’s premium housing markets. This trend is especially strong in markets such as Sydney and Melbourne.

Looking at the capital cities, trends show a split with LVRs in both Sydney and Melbourne decreasing over the past year to below 70%. At the other end of the spectrum, Brisbane, Adelaide and Perth have either risen or remained steady and are now all around 76%.

“It’s common for capital cities with weaker housing market conditions to experience an increase in average application LVR,” Samaha said. “For example, Perth’s application LVR has jumped from 72.8% to 77.1% in the past five years, sitting 2.8 percentage points above the national average.”

Driving factors

The CoreLogic and Veda index attributed the downward trend since 2013 to the increasing number of refinancing and mortgage top-ups for renovations and home extensions. First home buyers are also likely to have impacted the data with the total number decreasing from around 17% in early 2013 to a low of 12.9% in March 2016.

Tim Lawless, head of research at CoreLogic Asia Pacific, said the lower level of application LVR is also an indicator of more prudent lending standards and financial stability.

“Regulators and policy makers are likely to see the lower application LVR as a positive outcome, which is reflective of a more considered and prudent lending regime,” he said.

“One of the factors contributing to lower application LVRs is the heightened risk assessment many lenders are applying to select housing markets, whereby larger deposits are required to offset higher lending risk.”

Markets seen to be risky include those where dwelling values have grown significantly, those where supply levels have been high, and those which are exposed to singular industries such as mining, he said.

Related stories:

'Two speed property market' continues

First home buyers in decline despite affordability improvement

House price growth eases to slowest pace in almost three years