Aussie reported that several lenders are reducing interest rates, urging borrowers to reassess their mortgages to avoid the costly “loyalty tax”.

According to Aussie, several lenders have begun to lower their interest rates, offering relief to borrowers after a series of rate hikes.

Notably, Suncorp and Macquarie have made improvements of five and 10 basis points, respectively, both now offering rates at 6.14%. HSBC and Heritage Bank, which did not lower rates in the last cycle, are now among those with the lowest rates in the market at 5.99%.

Many Australian homeowners are currently facing what’s being dubbed the “loyalty tax,” as staying with their existing lenders without shopping around could be costing them significantly.

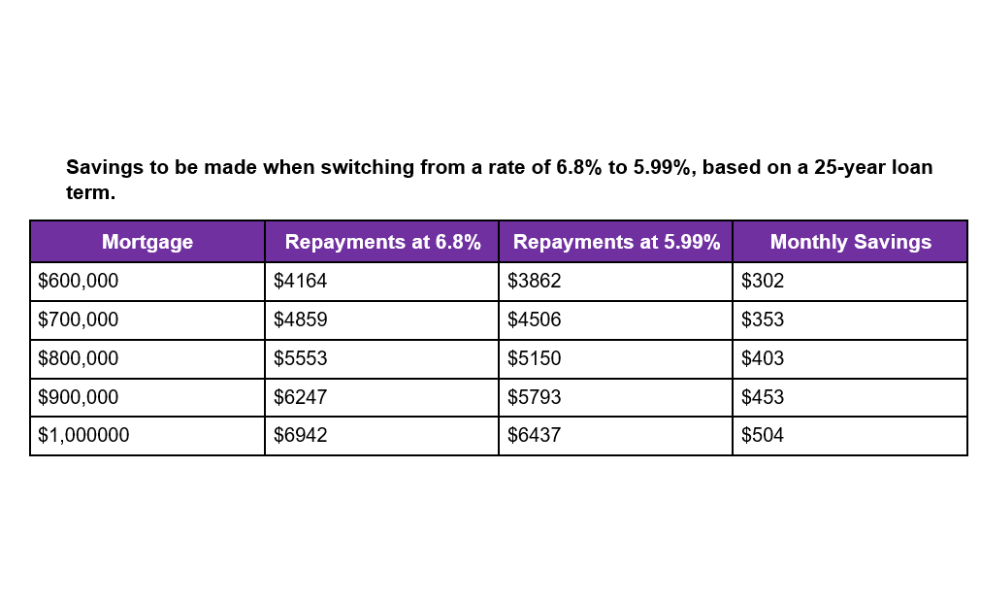

The national average mortgage rate stands at 6.8% on a loan amount averaging $624,000. According to Aussie, refinancing could lead to savings of about $300 per month for the average borrower.

Mel Smith (pictured above), an expert broker from Aussie Windsor, stressed the importance of being proactive about mortgage rates.

“It isn’t as hopeless as it feels at times out there, the tide is turning, but you need to know where to look. If you have an interest rate with a seven in front of it, or even in the high 6’s like many customers coming to me, there is plenty to be saved,” Smith said.

She also said that while improved rates are often extended to new customers, existing borrowers should also review their options.

“The improved rates are usually offered to new customers, but not exclusively, but it is always worth reviewing your rate and speaking with professionals to ensure you are not getting a loyalty tax with your existing lender,” Smith said.

The Aussie expert also pointed out the substantial benefits of even small reductions in interest rates.

“Even shaving 0.25 bps off your current rate will save you around $100 a month, or $1,200 across the year. It’s well worth having the conversation and considering switching so that it is you benefitting and not your current lender,” Smith said.

This approach could lead to significant financial gains over time, encouraging borrowers to actively manage their mortgage arrangements.

See LinkedIn post here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.