The national housing market has seen a dramatic rise in auction rates, according to the latest report from property data and analytics firm

CoreLogic.

The number of homes taken to auction increased to 2,641 in the week ending 23 October compared with 2,443 the week prior.

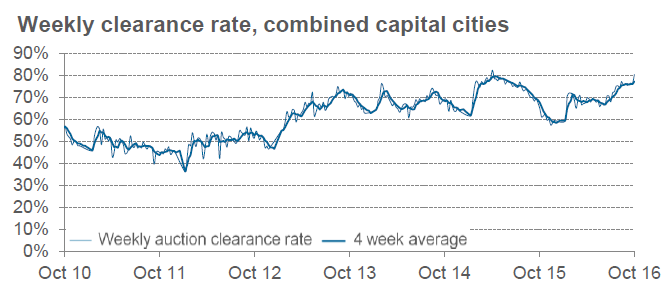

The preliminary clearance rate for last week lay at 80.2%: the highest recorded rate for the year so far. This represents an increase of 4% from the previous week.

“Over the corresponding week last year, the clearance rate was significantly lower at 64.9% however auction volumes were higher: 3,143 auctions were held,” wrote analysts at CoreLogic.

These high clearance rates extend to most markets across the country with every capital city except Perth recording preliminary clearance that was higher than a year ago.

In Sydney and Melbourne – the country’s two largest auction markets by a significant margin – the rates were 85.6% and 81.8% respectively. This was much higher than the same weeklong period last year in which clearance rates were 61.3% for Sydney and 69.7% for Melbourne.

In Sydney, regions with clearance rates over 90% included the Eastern Suburbs, Northern Beaches and Blacktown. While regions in Melbourne never reached this level, rates in the North West, Outer East and Inner South were over 85%.

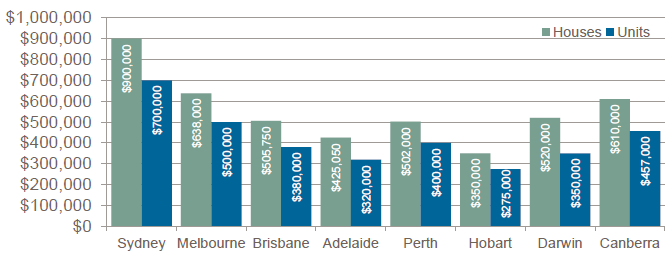

Looking at the home values over the year to date, prices have risen in every capital city expect for Perth which fell by 6.5%. The highest rate increases were 13.3% and 10.2% in Sydney and Melbourne respectively.

The median house and unit prices broken down by capital city are as follows:

Related stories:

Sydney house prices still a concern

September quarter a solid one for price growth

Inner Melbourne apartment market passes peak

Related stories:

Sydney house prices still a concern

September quarter a solid one for price growth

Inner Melbourne apartment market passes peak